Believe it or not, The Institutes’ has made the latest version of their CPCU 540 course easier!

To see what changed between the textbook for CPCU® 540 – Finance and Accounting for Insurance Professionals (3rd edition) and online-only course for CPCU® 540 – Impacting the Bottom Line of Insurance Financials (1st edition), we purchased the online course and did a comparison of the two.

We discovered that the newer course had a lot of the most challenging content removed, meaning the course will be noticeably easier for students testing on the latest version.

The biggest changes were the removal of several major sections from chapters 6, 8, and 11. Also, chapter 12 was removed in its entirety.

Here is a more detailed list of the differences we found when reviewing the two editions side-by-side:

Please note: We do not provide any guarantee or warranty that this is an all-inclusive list of the changes to The Institutes’ latest edition of this course.

Chapter 1 [intro to finance & accounting]

- Financial Transparency

- Sarbanes-Oxley Act of 2002 [reduced discussion]

- Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 [newly included]

Chapter 2 [about GAAP principles]

- Purpose of Financial Statements [reduced discussion]

- Notes to Financial Statements [reduced discussion]

- EDGAR: Electronic Data Gathering, Analysis, and Retrieval System [textbox removed]

- Letter to Shareholders [textbox removed]

Chapter 3 [about GAAP statements]

- Dupont Identity [section removed]

- Analyzing Financial Ratios Case [case study removed]

Chapter 5 [SAP analysis]

- A.M. Best Financial Strength Ratings

- Balance Sheet Strength [reduced discussion]

- Business Profile [increased discussion on innovation]

Chapter 6 [present/future value calculations]

- Future and Present Values of an Ordinary Annuity [major section, removed]

- Annuities Due [major section, removed]

Chapter 7 [financial markets]

- Interest Rate Risk [greatly reduced discussion]

Chapter 8 [bonds and stocks]

- Determinants of a Bond’s Yield of Maturity and Price [major section, removed]

- Derivatives [major section, removed]

- Valuing Bonds and Stocks [major section, removed]

- Financial Reporting of Bonds and Stocks [major section, removed]

Chapter 10 [insurer capital needs]

- Insurer Capital Needs [removed]

- Catastrophe Bonds [reduced discussion of special purpose vehicles (SPVs)]

Chapter 11 [capital management & capital requirements]

- Capital Structure [removed]

- Insurance Leverage [major section, removed]

- Insurer Cost of Capital [major section, removed]

Chapter 12 [mergers & acquisitions]

- [entire chapter removed]

CPCU 540 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 540: Contributing to Insurer Financial Performance (1st edition)

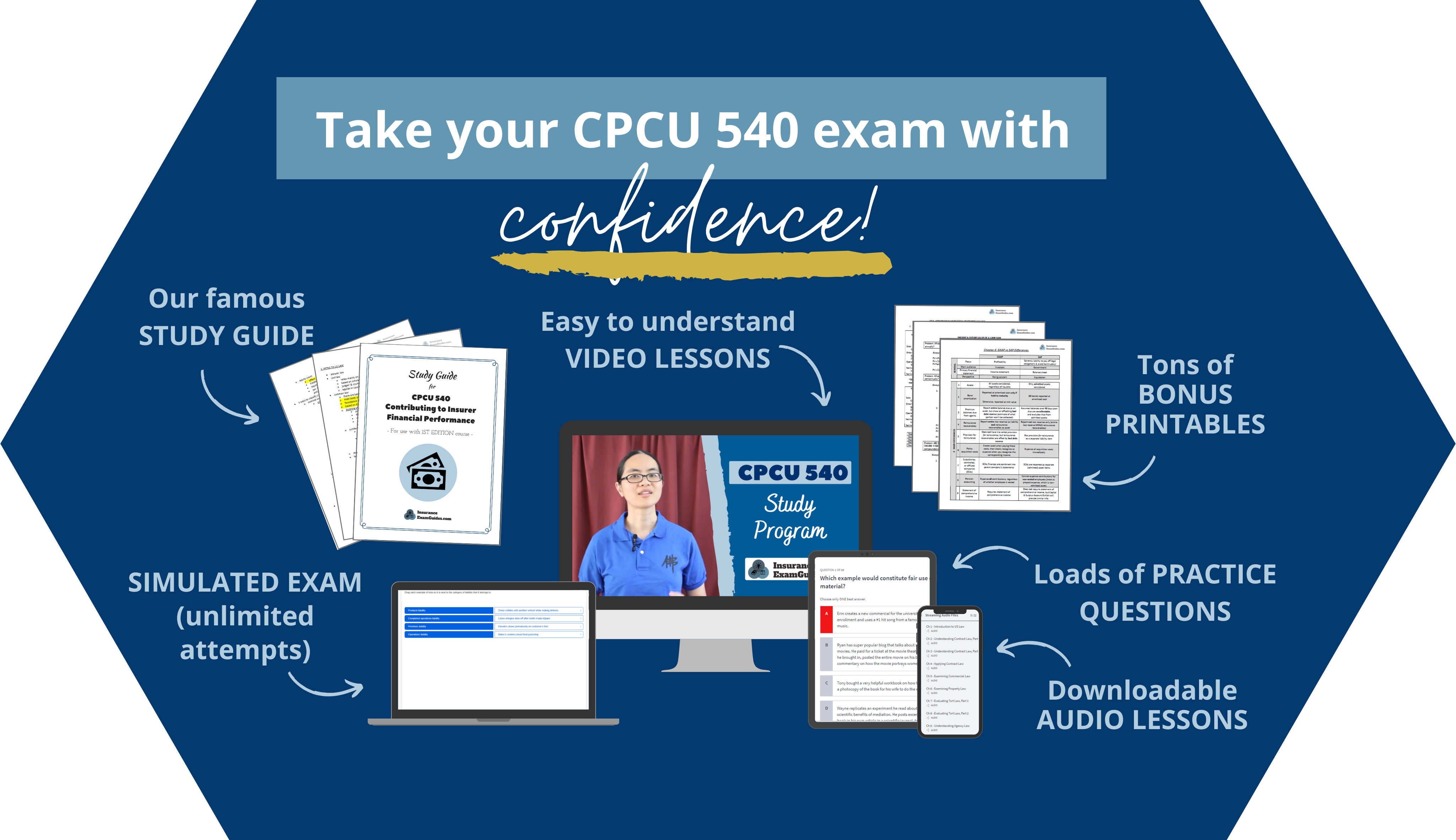

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.