For many insurance professionals, The Institutes’ AINS program is one of the first ones they’ll consider when looking into obtaining an insurance designation. In this post, we’ll go over everything you need to know about the exam for AINS 103: Exploring Commercial Insurance and give you tips on how to pass this test.

What’s in this post

- About AINS 103

- Tips for passing AINS 103 exam

- Learn about our AINS 103 online study program

- Buy our AINS 103 online study program

What is the AINS program?

The Associate in Insurance (AINS) is a professional designation is offered by The Institutes. After completing the program, you will have a basic understanding of how insurance industry works and can display the AINS designation on your business cards, resume, etc.

Having this designation shows that you’ve completed this extra education, which often makes you stronger candidate for hire or promotion. Also, customers, colleagues, and business partners will often feel more confident to work with you because they know you have this foundational knowledge.

To earn your AINS designation, you’ll need to take AINS 101, a concentration class (AINS 102 or AINS 103), and an elective class (see The Institutes’ website for list of eligible electives).

How does AINS compare to CPCU?

One of the most popular and well-respected designations in the insurance industry is the Chartered Property and Casualty Underwriter (CPCU) designation. Some students will choose to pursue their CPCU after completing the AINS program, or they might skip the AINS program altogether and go straight to doing the CPCU program. The two designations are separate, and you can choose to earn one without earning the other.

In terms of how they compare, the CPCU program is:

- Much harder

- Requires more classes

- More highly-regarded in the insurance industry

The benefit of doing the AINS program first is that you can get a feel for how The Institutes’ programs work and what it is like to sit for an exam. Also, some of the AINS courses can count towards the CPCU designation. However, it is important to note that the CPCU program is significantly more challenging and will require a lot more time. Each student should decide which designation(s) are right for them.

What is AINS 103?

AINS 103 is one of the two courses you can take to satisfy the concentration course requirement. The purpose of this course is to give you a broad overview of commercial lines of insurance (see later section for a list of covered topics). In particular, the Commercial Property Coverage Part, the Commercial General Liability (CGL) Policy, and the Businessowners Policy are heavily featured in this course.

About the AINS 103 exam

In order to demonstrate that you have understood the material from this course, you will need to pass an online exam administered by The Institutes.

You must go through The Institutes' website to purchase and formally register for your exam. When registering, you must indicate which test window you plan to take the exam during. The four test windows that are available every year are:

- January 15 to March 15

- April 15 to June 15

- July 15 to September 15

- October 15 to December 15

You may pay for your exam fee at any time, and those who register before the test window opens will usually receive a discount. However, you can only launch the exam and complete it during the test window you chose at the time of purchase. If you need to reschedule your exam, a new fee will apply.

The exam consists of 50 questions that cover all the chapters from the course, with a time limit of 65 minutes. The exam is done online, and you must get a score of 70% or better to pass. You may retake the exam (and pay a new fee) if you do not pass, but please check The Institutes' policies regarding how often and how soon you can retake the exam, as that may change from time to time.

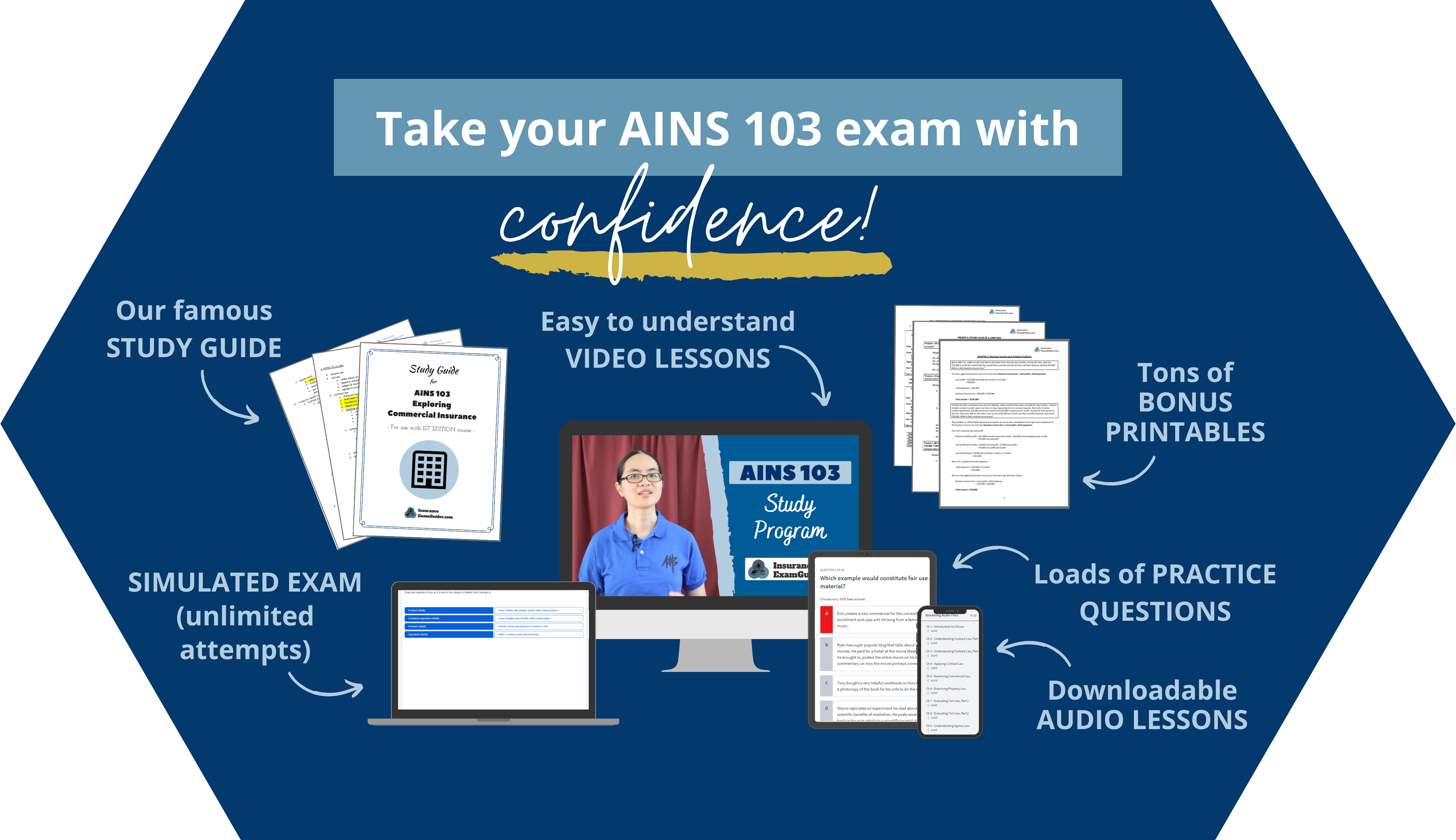

Get your AINS 103 study materials TODAY!

Looking for our printables-only package? Click here.

Topics Covered in AINS 103

Chapter 1: Why Do Businesses Need Insurance?

- Property Loss Exposures

- Business Income Loss Exposures

- Liability Loss Exposures

- Auto and Transportation Risks

- Marine Loss Exposures

- Workers Compensation Exposures

- Risk in a Connected World

Chapter 2: What is in a Commercial Property Policy?

- Components of a Commercial Property Policy

- Building & Personal Property Coverage

- Business Income Coverage Form

Chapter 3: What is in a Commercial General Liability (CGL) Policy?

- Components of a CGL Policy

- Property Coverage (HO3)

- Coverage A: Bodily Injury & Property Damage Liability Form

- Coverage B: Personal Injury & Advertising Liability Form

- Coverage C: Medical Payments Coverage Form

Chapter 4: What Other Policies Do Businesses Need?

- Business Auto Coverage

- Workers Compensation & Employers Liability Policies

- Excess & Umbrella Policies

- Equipment Breakdown Insurance

- Commercial Crime Insurance

- Inland Marine Coverage

Chapter 5: How is Coverage Tailored for Small Businesses?

- Businessowners Policy (BOP) Eligibility

- BOP Property Coverage

- BOP Liability Coverage

Chapter 6: What are the Key Personal Insurer Roles?

- Underwriters

- Sales & Producers

- Claims

Get your AINS 103 study materials TODAY!

Looking for our printables-only package? Click here.

Tips for passing your AINS 103 exam

1) Pay attention to policy exclusions

Some of your exam questions will present you with a scenario where a person is making a claim for the costs that they incurred due to a loss. You will then asked to calculate how much of that loss the insurer will cover.

The trickiest part of these questions is remembering what things are and aren’t covered. The Institutes’ course will cover these policy exclusions, but their discussions of these exclusions are very brief so they might not seem that important when you are learning about them. However, make sure you are very familiar with them because they are key to determining what is covered. You are bound to have at least a few of these situational questions on your exam

2) Know your definitions

There are lots of definitions in this course. It is important to be familiar with all of them, and you should review them all again right before you take your exam. One way to effective review is to use our study guides.

3) Don’t waste too much time on long questions or questions that you are stuck on

Every test question is worth only one point, no matter how simple or complex it is. If you find that you are spending a lot of time on one particular problem, you are better off guessing for now and using the option to flag the question so you can return to it later. You don’t want to spend so much time that you run out of time before you can get to all the other questions that might have been easier for you to score points on.

4) Put an answer for every question

You do not get minus points for getting a question wrong, so don’t leave any questions blank.

5) Get as much practice as possible

The best way to ensure that you know how to apply the concepts you learning is to practice doing so, and practice quizzes are the perfect way to do this.

Our online course for AINS 103 includes tons of practice questions, as well as a simulated exam that you can reattempt as many times as you want.

The Institutes’ online course also includes practice quizzes and a simulated exam, but you are only allowed one attempt at the simulated exam and you cannot review your answers once you close that browser tab. The Institutes used to have a Smart QuizMe app that also provided practice questions, but they have since removed the question banks for all the current CPCU & AINS courses from the app. At this time, we do not think that The Institutes will be updating their app to include new CPCU & AINS question banks, since The Institutes has not announced any specific plans to do so.

6) Aim to understand the practice questions and not just memorize them

The questions on the actual exam are not made up of the practice questions, so you cannot just rely on memorizing those answers for any practice quizzes and simulated exams you take. Read each explanation and re-review the material until you understand why you got a question wrong.

7) Don’t rely solely on The Institutes’ study materials

The Institutes’ way of explaining things is not necessarily the best way, so take advantage of other resources available to you. Some students don’t use The Institutes’ study materials at all and prefer to go with another study option, such as our comprehensive online courses. We use plain English to explain all of the concepts, include helpful illustrations that help you see how a concept works, and show you how different elements of something relate to one another.

You can also turn to Google and YouTube to look for explanations and examples from other sources too.

8) Join The Institutes’ Chat Facebook group

Join The Institutes’ Chat Facebook group to find fellow AINS students. The group members can provide you with feedback on test questions that might be stumping you, give you professional tips for propelling your insurance career, and provide moral support and motivation.

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get your AINS 103 study materials TODAY!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.