The Institutes has released an updated version of CPCU 520, with a new course title: CPCU 520: Meeting Challenges Across Insurance Operations. Keep scrolling to see our full review and a list of how the topics have changed.

Summary of changes:

- Chapter 9 (data & technology) has been removed, but topics relating to how tech affects each dept have been incorporated into the other chapters

- Chapter 10 (strategic management) has been removed

- New chapter on underwriting specifically for personal lines insurance has been added

- Fewer & simpler calculations

- Vertical and trend analysis from the expiring version of CPCU 540 is now in the new CPCU 520 course

- Major changes to simulated exam

Exam information:

- For third quarter (Q3) test window: Exam is based on the expiring version of the course, CPCU 520: Connecting the Business of Insurance Operations. The last day to test on this version of the exam is September 15, 2023.

- For subsequent test windows: Exam will be based on the new version of the course, CPCU 520: Meeting Challenges Across Insurance Operations.

Details of overall changes:

1) Improved visual look: The new interface is more colorful and visually appealing.

2) Improved word choice: The wording in the new courses is much simpler and easier to understand than before.

A big complaint about prior courses was that the wording was too verbose and used overly complex word choices that were not necessary. That made it more difficult to follow along and stay attentive, but the newer course is much better about this.

3) Majority of content is still text: About 90% of the course content is still text-based, meaning you still have to do a lot of reading.

This is very surprising because The Institutes had stated on their CPCU FAQ page that “the learning experience is being updated to match the needs of today’s busy adult learner—including more videos and interactions to help students acquire and retain the skills they need to be leaders.” We did not find any interactive modules within the assignments themselves, and the practice quizzes & practice exam did not appear to have any changes. The only portion of the course that included a new style of activity was the simulated exam, which we discuss in further detail in #5 below.

On a side note regarding the video content: you do have the option to turn on captions and change the speed of the video. We found the videos much easier to watch at a faster speed and with the captions on.

4) Fewer & simpler calculations: Newer course covers fewer formulas and simpler reinsurance calculations.

The expiring version of CPCU 520 had a lot of ratio formulas that also appeared in CPCU 540. Those formulas have been almost entirely removed from CPCU 520, presumably to minimize overlapping content.

Additional, the chapter on reinsurance is a bit easier because there were virtually no practice questions that required you to do math. In the expiring course, students would commonly be given the terms for an insurer’s reinsurance policy and a specific claim scenario, and then have to calculate how much the reinsurer would cover under the reinsurance policy. In the updated course, though, the practice questions relating to reinsurance are more general and theoretical in nature, with little to no calculations required.

5) Simulated exam:

In the newer course, the simulated exam uses the same interface as the actual exam, so it does a much better job of mimicking the true exam experience.

More importantly, the simulated exam included non-multiple choice questions, such as type-in-the-blank, drag-and-drop, and multi-choice multiple choice questions (where more than one of the answer choices is correct). For a detailed discussion of these question types, see our post Virtual exam information.

We did email The Institutes to inquire if the actual exam will include these new question formats, and they responded that “No changes have currently been made to designation credentialing exams or the corresponding grade reports.”

One more thing worth noting about the simulated exam is that once you finish the test, review what you got wrong, and close out of it, you can no longer access the exam attempt again to re-review the questions.

List of topics covered:

The list below shows the main topics covered in the expiring course, CPCU 520: Connecting the Business of Insurance Operations. We have noted what topics have been removed and where the remaining topics appear in the new version of the course in the following manner:

- Sections that do not appear in the newer course with the same level of detail are stricken out (in some cases, minor references to the same topics may still appear in the new course in other places)

- Which chapter each topic can be found under in the new course

- List of new topics that are not covered in the expiring course

Note: We do not provide any guarantees or warranties regarding the accuracy and comprehensiveness of this list.

Chapter 1: [overview of insurance operations]

- Main goals of insurance companies

- Ways to classify insurance company

- Measuring an insurer’s performance

- Functional view of insurance [Chapter 1]

- Digitization of insurance

Chapter 2: [insurance regulations]

- Overview of insurance regulation [Chapter 1]

- Insurance licensing [Chapter 1]

- Monitoring an insurer’s solvency [Chapter 1]

- Regulating insurance rates

- Regulating insurance policies & market conduct

Chapter 3: [marketing insurance]

- Overview of insurance marketing [Chapter 5]

- Eight key marketing activities [Chapter 5; section on product development greatly expanded and added to Chapter 1]

- Distribution systems & marketing channels [Chapter 5]

- Common functions of a producer [Chapter 5]

- How to choose a marketing system [Chapter 5]

Chapter 4: [underwriting department]

- Overview of ratemaking [Chapter 3]

- Establishing & implementing an underwriting policy

- The underwriting process [Chapter 3]

- Measuring underwriting results

Chapter 5: [risk control & premium auditing]

- Overview of risk control

- How risk control affects other functions [incorporated into multiple chapters of new course]

- Overview of premium auditing [modified, Chapter 7]

- The premium auditing process

- How premium auditing affects other functions [incorporated into multiple chapters of new course]

Chapter 6: [claims department]

- Overview of the claims department [Chapter 2]

- Claims personnel [Chapter 2]

- Evaluating claims performance & compliance [Chapter 2]

- The claims handling process [Chapter 2]

- Framework for analyzing coverage

Chapter 7: [actuarial department]

- Overview of the actuarial function [Chapter 7]

- Overview of ratemaking [Chapter 7]

- Main methods of ratemaking [Chapter 7]

- The ratemaking process [Chapter 7]

- Ratemaking variances [Chapter 7]

- Loss reserve analysis

- The loss development method

Chapter 8: [reinsurance]

- Main functions of reinsurance [Chapter 6]

- Main sources of reinsurance

- Two main types of reinsurance [Chapter 6]

- Pro-rata reinsurance [Chapter 6]

- Excess of loss reinsurance [Chapter 6]

- Reinsurance layering [Chapter 6]

- Alternatives to traditional reinsurance

Chapter 9: [data & information technology (IT)]

- Ways to use IT

- Data quality and data management

- Information needs of insurance companies

- Security & control of IT systems

- Aligning company strategy with IT

Chapter 10: [strategic management]

- Stages of the strategic management process

- Five Forces Model & SWOT analysis

- Deciding strategy at different organizational levels

[new topics]

- About the value chain model [Chapter 1]

- Working with third-party claimants [Chapter 2]

- Use of IT in claims department [Chapter 2]

- Analyzing financial statements [Chapter 3; formerly part of CPCU 540]

- Vertical & trend analysis [Chapter 3; formerly part of CPCU 540]

- Re-underwriting [Chapter 3]

- Underwriting for personal lines [Chapter 4]

- Identifying loss exposures

- Identifying hazards

- Gathering underwriting data

- Impact of technology

- Insurance portfolio analysis

- Risk modeling

- Developing a reinsurance program [Chapter 6]

Frequently asked questions (FAQ) for IEG products

Which course version is IEG products based on?

- We have updated our study materials to reflect the new course. When clicking the “Buy Now” button, the updated study materials will be added to your shopping cart.

- All students who are enrolled in the expiring version of our study program can request a free upgrade to the updated version by emailing us at info@insuranceexamguides.com

How can existing customers get access to the new study materials?

- If you bought a study guide bundle: Use the download link you received in your order confirmation email to download both versions. We have also emailed all prior customers with these same instructions.

- If you bought an online study program: Please email us at info@insuranceexamguides.com from the email address you use to sign on to request enrollment in the updated course.

Join our mailing list to get notified when the new course is available!

Get a free study plan generator and CPCU progress tracker!

Join our mailing list and score these free tools.

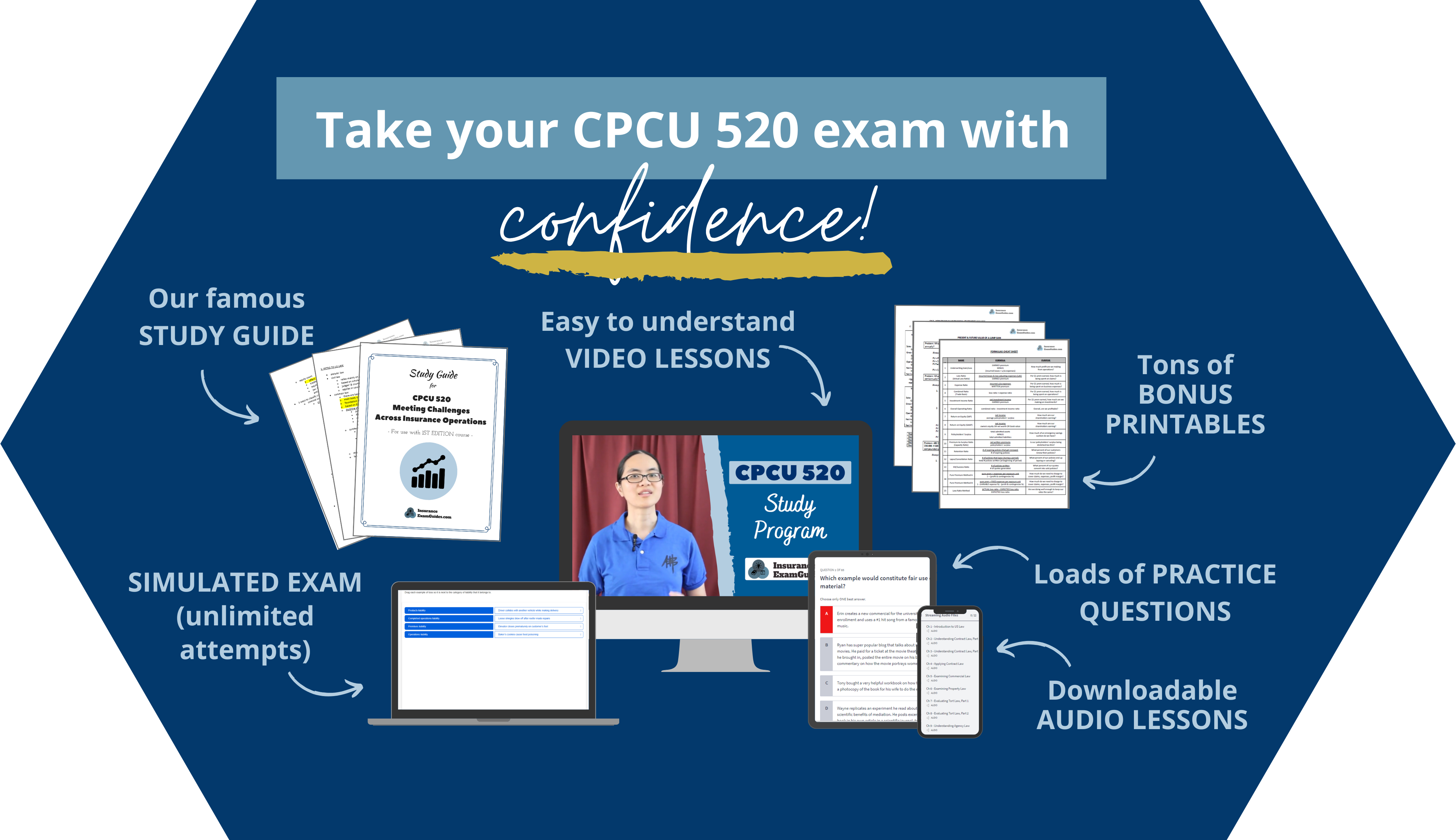

Get Your CPCU 520 Study Materials NOW!

Looking for our printables-only package? Click here.

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.