In CPCU 540, there are several concepts that are referred to right from the start and continue to appear repeatedly throughout the textbook, but for some reason, The Institutes’ course does not immediately define these concepts nor does it provide a thorough explanation of them. Understanding these concepts well will make a huge difference in your ability to grasp the CPCU 540 content, so we created our 3-part CPCU® 540 Fundamentals series to provide the introductory lessons you need.

Before you even crack open the textbook, start by learning these foundation concepts to get a leg up on mastering the content in CPCU 540. The very first thing you’ll want to learn is the accounting equation.

Prefer to watch this post’s content instead of read?

Check out our YouTube video below and subscribe to our channel, or just keep scrolling if you’d rather read.

The Accounting Equation

All aspects of accounting are based around the accounting equation. Very simply, the equation is as follows:

ASSETS = LIABILITIES + EQUITY

Assets refers to any property of value. They can be tangible (like cash, real estate, vehicles) or intangible (like the value of a patent). In a business, you will use your assets to produce a good or provide a service that you can sell, which hopefully generates profits.

Liabilities refers to any legal obligations you have to repay money back to someone within a certain timeframe. Note that moral obligations are not a financial liability; only legal financial ones (where someone could sue you for failure to pay them back) are considering within the scope of accounting.

For now, just think of equity as a catch-all category that includes anything that doesn’t count as a liability. There are various terms that are used interchangeably with the term equity, such as net worth or book value. We will revisit this term later after we have given you some additional context first.

Essentially, the accounting equation is saying that any time you obtain something of value (an asset), you are going to keep track of whether you acquired it by 1) incurring a liability or 2) using equity. Think of the two sides of the equation as being on a balance: On one side, you have an ASSET bucket, and on the other side, you have a LIABILITY bucket & an EQUITY bucket that together weigh the same as the ASSET bucket. Any time you drop something in the ASSET bucket, you must put an equal amount in either the LIABILITY bucket, the EQUITY bucket, or both. The easiest way to understand this is to use an example, which we will do in the next section.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

How Does it Work?

Let’s walk through how your accounting equation might develop if you were to start a new food truck business:

To start a new company, you need money to buy things. One option is to borrow the money. If you decided to borrow $50,000 from the bank, you would receive that much cash and record it on your ASSET side. Then, since you got the funds from a loan that you are legally obligated to pay back within a certain time, it qualifies as a liability, so you would put the same amount in the LIABILITY bucket to keep both sides of the equation balanced. At this point, your equation is:

ASSETS $50,000 (cash) = LIABILITIES $50,000

If you decided not to borrow money and instead used your own personal savings to start the business, you would still show the same $50,000 cash on the ASSET side. However, the other side would show the money in your EQUITY bucket instead of your LIABILITY bucket because you don’t have a legal obligation to pay back that $50,000 to anyone within a specificed time. In this situation, your equation would look like this:

ASSETS $50,000 = EQUITY $50,000

In comparing the two, having more equity instead of more liabilities always looks better because you don’t have a legal obligation to pay the equity portion back to anyone at a specified time. In contrast, liabilities are basically someone else’s money, and at some point you’ll usually have to come up with the funds to pay back the debts you are incurring.

Now, let’s say you spend $30,000 of your equity to buy a food truck, and another $500 to get food supplies. All you’ve done is split your assets into multiple categories: “cash,” “supplies,” and “vehicles.” You haven’t actually increased or decreased what you have altogether, so your equation would reflect the change like so:

ASSETS $50,000 ($30,000 vehicles + $500 supplies + $19,500 cash) = EQUITY $50,000

Next, if you use those food supplies to create some dishes and brought in $1500 in sales, your supplies are now used up but you have more cash, so your asset side now look like this:

$30,000 vehicles + $0 supplies + $21,000 cash = $51,000 ASSETS

Remember, the accounting equation must always balance, so you need to increase the LIABILITIES/EQUITY side of the scale by the $1000 of profit you made. Any time you increase or decrease your total assets, you will always have a corresponding increase or decrease on the liability/equity side by the same amount – there is no exception to this rule! So the question is, which category would the $1000 in profit fall under: liability or equity?

The main question you need to ask is: did you get that asset by incurring a new debt or obligation to someone that you must pay back? If so, the offset belongs in the LIABILITY bucket. If not, it belongs under EQUITY. In this case, the extra $1000 is self-made profit that you created without incurring any new debt to anyone, so you can stick it in the EQUITY bucket. At this point, your accounting equation will look like this:

ASSETS $51,000 ($30,000 vehicles + $0 supplies + $21,000 cash) = EQUITY $51,000

Now, what if you spot a great deal on a second truck for $20,000 and want to buy it to expand your business? You have the option of using the cash you have, but that leaves you with only $1000 of cash afterwards, which is too little money to buy more food supplies and hire a driver for the second truck. If you decide to take on a car loan for the new truck, your new accounting equation would reflect the new truck and the corresponding loan as follows:

ASSETS $71,000 ($50,000 vehicles + $21,000 cash) = LIABILITIES ($20,000 car loan) + EQUITY ($51,000)

We can also use a personal finance example to help you grasp the liabilities-versus-equity concept:

People often talk about buying a home and “building equity.” When most people buy a home, they can’t afford to pay for it outright in cash, so they borrow a good chunk of it. Let’s say you buy a home for the price of $250,000 with a down payment of $50,000, meaning you had to borrow $200,000 to pay the seller. At the time of the sale, the accounting equation for the home would look like this:

ASSETS $250,000 (home) = LIABILITIES $200,000 (mortgage) + EQUITY $50,000

As you start to pay down your mortgage, you get to reduce the liabilities portion of this accounting equation because you owe less and less to your bank with each payment that you make. However, the purchase price of the home doesn’t change, so you wouldn’t change the assets section. The only way to keep the equation balanced is to offer the reduction to your liability with an increase to the equity portion. As such, if you have paid off $5,000 of your mortgage by the end of the year, your updated accounting equation would be:

ASSETS $250,000 (home) = LIABILITIES $195,000 (mortgage) + EQUITY $55,000

You can see, then, that the equity portion is basically the portion of your home that you own free and clear, the part that is truly yours. It represents the part of your asset (the home) that is not owed to anyone else. Until you pay off the home, you don’t really have a $250,000 home – you have part of a $250,000 home. If you had to sell the house before you paid off your mortgage, you don’t get to pocket the full $250,000. You still have to pay the bank for the remaining balance of your loan, and you’ll only get the remaining equity amount.

By a similar token, when you look at a business, this is why keeping track of their liabilities and equity is important: so you can see how much of their assets is truly theirs. A company with a lot of assets but also a lot of liabilities is basically running themselves on borrowed money. You want to see either a healthy portion of equity, or at least a trend of the equity continuing to go up because they are profitable.

Now that you understand that equity refers to non-debt sources of money, it is helpful to know that the two main sources of equity for businesses is contributed capital and retained earnings.

Contributed capital refers to money that people invest into a business that isn’t structured as a loan. We highly recommend reading our other lesson on what stocks are and how they work before you begin your CPCU 540 studies too.

Retained earnings is the profit that a company makes on their sales, which they choose to keep within the company rather than distributing it with the company owners. Companies will usually keep most of their profits within the company because the business will always need at least some money to pay for expenses and buy more inventory. Only when they have profit to spare will they consider distributing some of those earnings to the owners of the company.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

Some Key Observations

We’ve pointed out that this equation pretty much tells you how much of your stuff (assets) was obtained with borrowed funds (liabilities) versus how much is outright yours, free and clear (equity).

In general, it is obviously preferable if most of your stuff is yours outright rather than for it to have been purchased with borrowed money that you’ll eventually have back. If you don’t have that money available when your liability repayment is due, you’ll have no choice but to sell your assets (such as those food trucks from our earlier example) to generate the funds needed to repay those loans.

With equity, there is no pressure to earn enough to pay back a debt. Put another way, liabilities represent what portion of your assets are only temporarily yours, that you ultimately have to give back to someone else unless you can buy them out.

Financial Statements

Accounting is merely tracking what happens with the three buckets (assets, liabilities, equity) and reporting that information via financial statements.

A balance sheet is like taking a snapshot of the buckets. It focuses on a specific moment in time, and it tells you what you had in each of your three buckets (assets, liabilities, equity) on a specified date. The balance sheet can look complicated because there are lots of sub-categories within each of the three buckets, but that’s just to help you see exactly what your asset, liability, and equity buckets consist of.

By comparison, an income statement is more like a video, which shows you what is happening to the buckets over a period of time. The statement will have a start & end date, and it summarizes what occurred during that window of time to help you calculate whether you made a profit or loss by the end of that period.

How Does This Help You with CPCU 540?

First off, the accounting equation is one of the formulas covered in CPCU 540, so hopefully this in-depth coverage of it has ingrained the equation ASSETS = LIABILITIES + EQUITY into your mind.

More importantly, though, much of CPCU 540 is about how various situations could affect these three categories. Any time the book goes on about how a particular increase or decrease in assets results in an increase or decrease on the liability/equity side, you’ll really get it because you understand the balancing act between the ASSETS bucket and the LIABILITIES/EQUITY bucket.

CPCU 540 also devotes a lot of time to pointing out ways in which transactions are recorded into the buckets differently for insurance companies compared to how they would be recorded in other industries, due to the unique nature of insurance products. For example, when a typical retailer sells a product, they will update the asset side to show the reduction to their inventory and the increase to cash for the money they got from the customer, and then they’ll offset those two entries by recording the difference (their profit amount) in the EQUITY bucket.

An insurance company, though, is not allowed to record the premium right away as income/profit in the EQUITY bucket because technically, they haven’t earned the money yet. If an insured were to cancel their policy tomorrow, the insurance carrier would owe them an immediate refund. So, at the time of sale, the cash increases but the offset is recorded as a LIABILITY, because at that precise moment, the insurance company has a legal obligation to give back that money if things don’t work out. Then, as time elapses and the insurance company is considered to have earned the premium, the profit slowly gets shifted over to the EQUITY bucket until the entire policy period elapses & the whole thing is considered truly earned by the insurance company.

Now that you understand the balancing concept, it is easier to conceptualize a transaction’s affect on both sides of the scale.

Finally, because we’ve explained why equity is generally preferable to liability, you’ll understand why CPCU 540 places so much emphasis on transactions that boost the equity bucket and warns about transactions that deplete it. Since equity represents the portion of your assets that aren’t owned by someone else, it now makes all the sense in the world why you want to do things in a way that increases the equity portion rather than the liability portion.

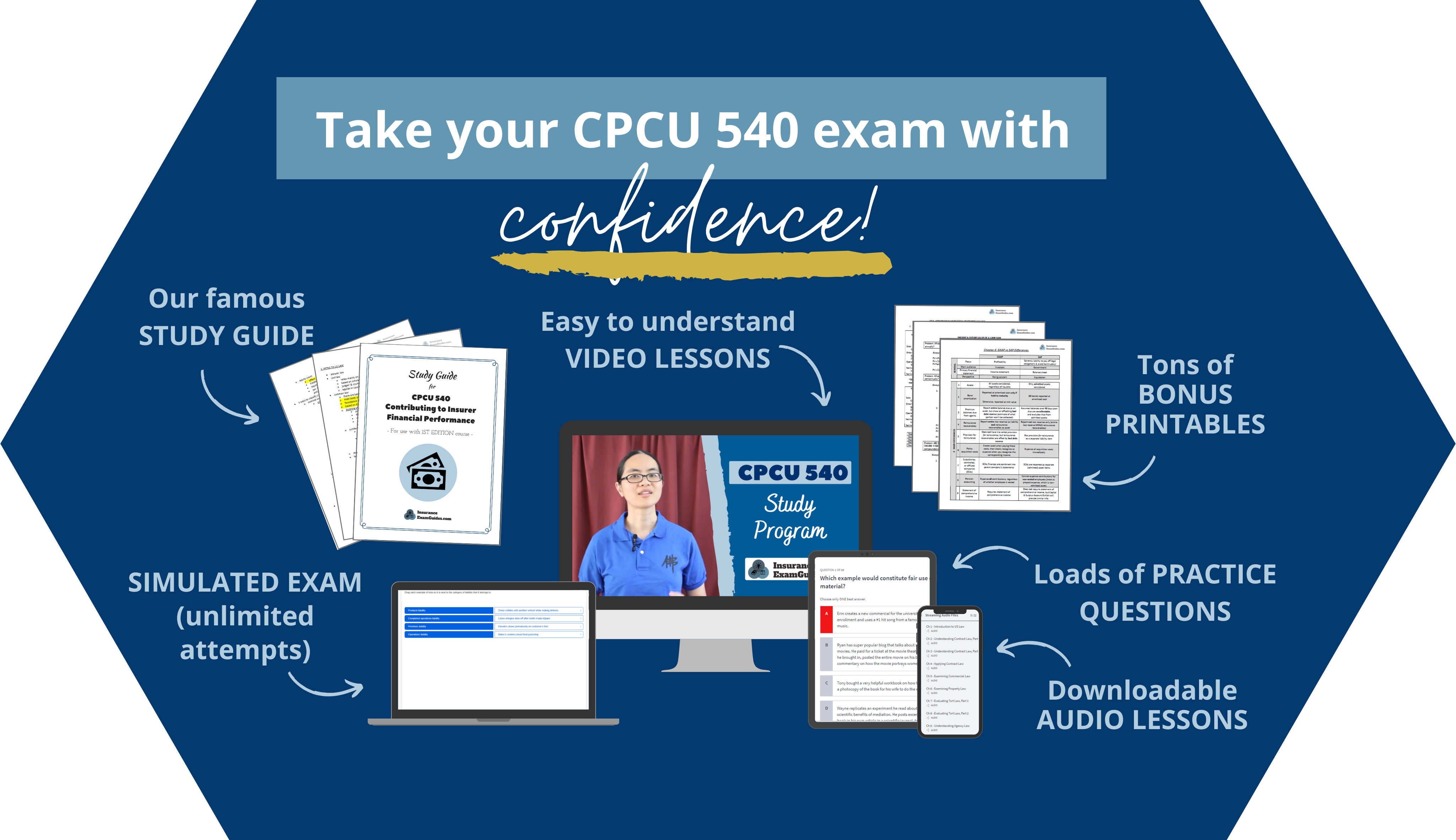

CPCU 540 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 540: Contributing to Insurer Financial Performance (1st edition)

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.