What is CPCU 551?

CPCU 551 is one of four concentration courses you may choose from earn your CPCU designation. Whether you are pursuing the traditional CPCU path or the ARM to CPCU path, all students must choose between completing the commercial lines concentration courses or the personal lines concentration courses. CPCU 551 is one of the two commercial lines concentration courses.

This particular course is about the various types of insurance policies available for commercial property damage exposures. The knowledge you gain from this course will help you understand what types of commercial policies are available, how coverage typically applies for each of those policies, and what are the key considerations that producers and customers must think about when deciding on their policy terms and coverage options.

How difficult is CPCU 551?

CPCU 551 involves diving deeply in the policy contract terms that apply for various types of commercial policies. Especially for students who have no experience with commercial policy language, CPCU 551 can be one of most challenging courses for several reasons:

- There are many, many little details to remember and numerous exceptions to the general rules

- There are many endorsements that can used to negate a policy’s standard terms, so you have to remember that the rules are under the standard policy terms and then how the rules are changed if an endorsement is present

- There are several types of multi-step calculations you may need to complete

- Many of the exam questions are situational, where you need to be familiar with all the policy types and endorsements to know which one would be best for the scenario at hand

- Many similar clauses or policy types that are mostly similar but have small differences, and you need to be able to differentiate based on those small differences

If you are using The Institutes’ online course for CPCU 551, there are some aspects that make it difficult to easily review everything again to refresh your memory before test time:

- The sheer amount of detail (which is written mostly in prose and lacking in cheat sheets)

- Many of the explanations on how to do calculations are in video form, so you need to rewatch, pause, rewind to re-review the steps

- The order that the material is organized is not always intuitive/ideal

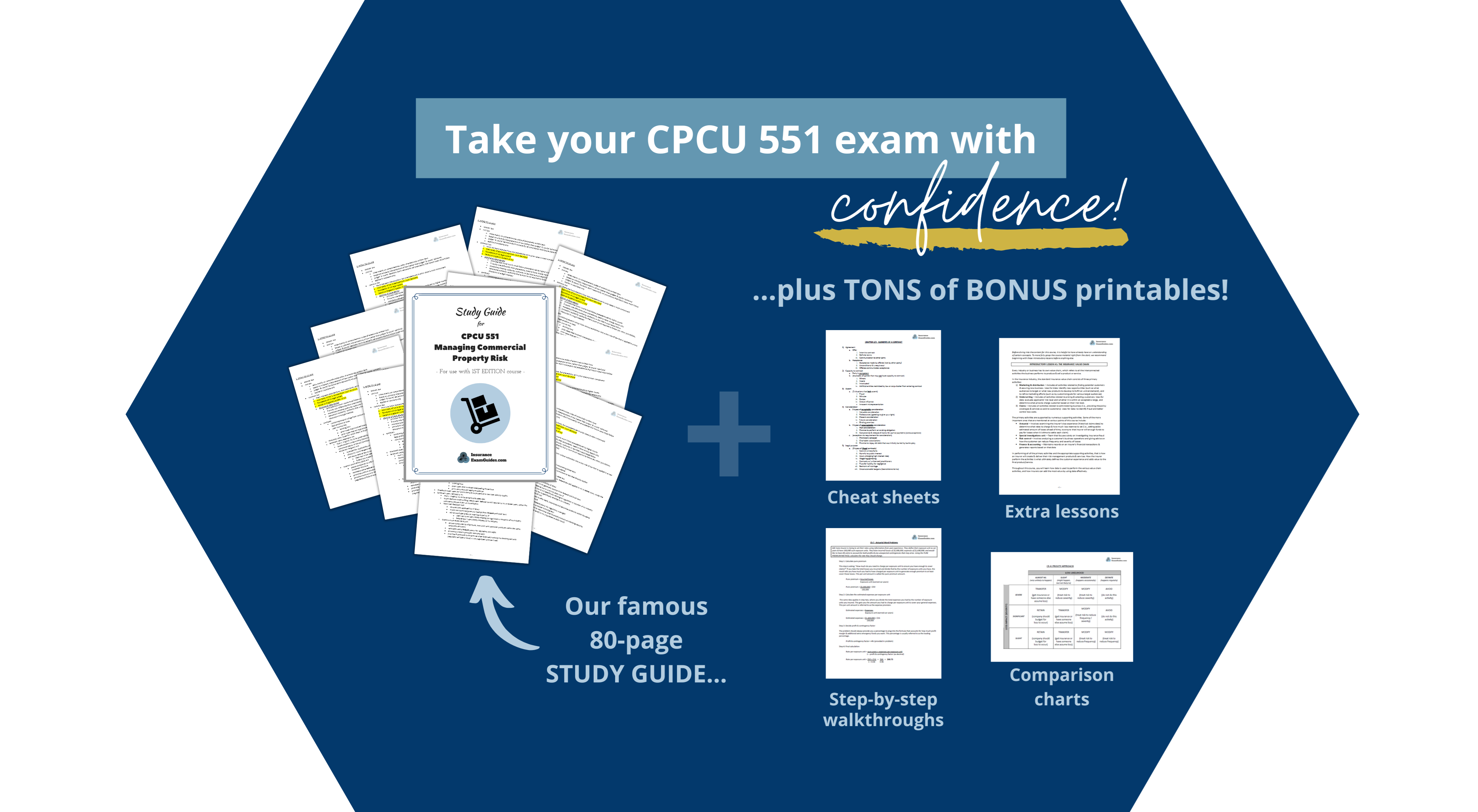

Our study guide bundle and bonus printables are the perfect supplement to The Institutes’ course, and provides tons of tools to help you effectively review everything you need to know:

- Cheat sheets

- Written step-by-step walkthroughs on how to do the various calculations

- Extra lessons to give you helpful background knowledge that will improve your understanding of the materials

About the CPCU 551 exam