by Stacy T. | Apr 9, 2018 | CPCU 540

In this part of our three-post CPCU® 540 Fundamentals series, we will teach you about stocks and bonds. The Institutes’ doesn’t go into these types of investments too much until Chapter 8, but they come up right from the start of the course and reappear over and over again throughout the entire course. You are much better off if you go into your studies already having a basic understanding of the main differences between stocks and bonds.

Both are key ways for any business, including insurance companies, to raise money to run their operations. Also, insurance companies earn a lot of their income from investments, which will include stocks and bonds. As such, there is much to know about stocks and bonds, from both the perspective of being a buyer and also from being a seller.

(more…)

by Stacy T. | Apr 3, 2018 | Announcements, CPCU 500

Update: A detailed list of changes to CPCU 500 is now available here.

Additional information has been made available regarding The Institutes™’ upcoming changes to the CPCU 500 course. As mentioned in a previous blog post, The Institutes’ confirmed that one of the courses they would be updating this month was CPCU 500 – Foundations of Risk Management & Insurance™. According to Kirstie S. Fellenbaum, Senior Customer Success Specialist & Course Sponsor Coordinator for The Institutes™, the changes have now been finalized.

The new third edition textbook will include updates relating to the below topics (for your ease of reference, we have also indicated which chapters these topics are currently covered in within the second edition textbook):

(more…)

by Stacy T. | Apr 2, 2018 | CPCU 520, CPCU 540

In this part of our three-post CPCU® 540 Fundamentals series, we will delve into one of the most important insurance-related financial concept: policyholders surplus. Because this concept comes up so often through the entire course, you are much better off if you go into your studies already having a basic understanding of what the policyholders surplus is.

To improve your understanding of this discussion, we recommend that you read our other lesson about the accounting equation before diving into this one.

(more…)

by Stacy T. | Mar 27, 2018 | CPCU 540

In CPCU 540, there are several concepts that are referred to right from the start and continue to appear repeatedly throughout the textbook, but for some reason, The Institutes’ course does not immediately define these concepts nor does it provide a thorough explanation of them. Understanding these concepts well will make a huge difference in your ability to grasp the CPCU 540 content, so we created our 3-part CPCU® 540 Fundamentals series to provide the introductory lessons you need.

Before you even crack open the textbook, start by learning these foundation concepts to get a leg up on mastering the content in CPCU 540. The very first thing you’ll want to learn is the accounting equation.

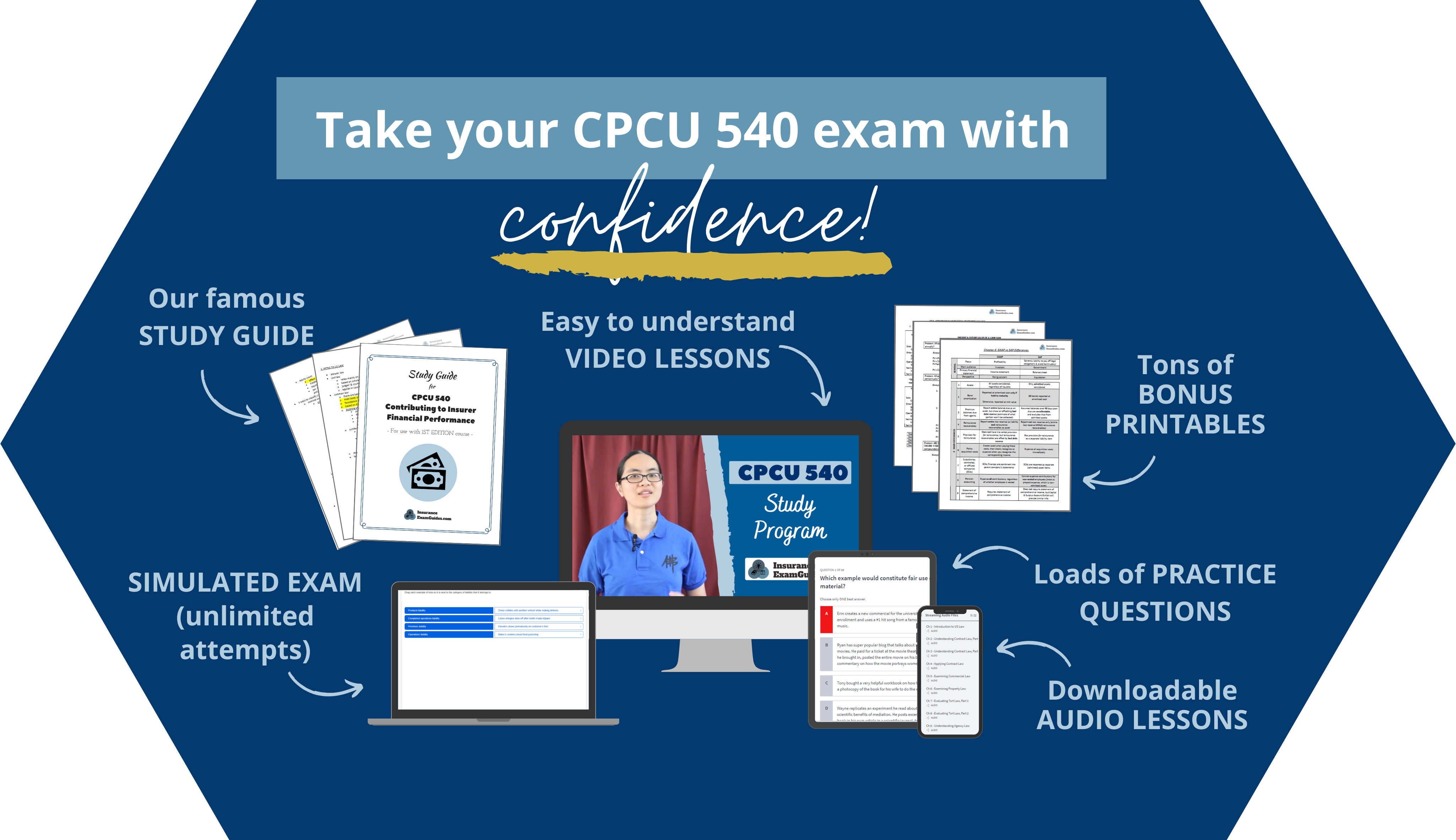

Get Your CPCU 540 Study Materials NOW!

Looking for our printables-only package? Click here.

Prefer to watch this post’s content instead of read?

Check out our YouTube video below and subscribe to our channel, or just keep scrolling if you’d rather read.

The Accounting Equation

All aspects of accounting are based around the accounting equation. Very simply, the equation is as follows:

ASSETS = LIABILITIES + EQUITY

(more…)

by Stacy T. | Mar 13, 2018 | CPCU 520, CPCU 540

A commonly-asked question about the CPCU® program is what order you should take the classes in. Since none of the classes have a prerequisite, you can take them in whatever order you want. That said, we recommend taking CPCU 520 (Insurance Operations) right before CPCU 540 (Finance & Accounting for Insurance Professionals) for these reasons:

(more…)