by Stacy T. | Mar 6, 2018 | Announcements, Study Tips

Many insurance companies provide incentives to encourage their employees to pursue the CPCU® and AINS® designations. For companies that don’t, their employees don’t have to assume that their workplace is not willing to provide support in some way. In this post, we’ll talk about how to ensure that you are utilizing all the CPCU or AINS benefits your workplace has to offer, and how to ask your employer to consider providing benefits if they don’t already do so.

Topics covered:

- Find out if your company covers more than just exam fees & textbooks

- Tap into non-financial CPCU and AINS resources that your company may offer

- Get a CPCU Presidential Scholarship with the help of your workplace

- How to ask your workplace to cover your expenses if they don’t already offer it as an employee benefit

(more…)

by Stacy T. | Feb 28, 2018 | CPCU 500

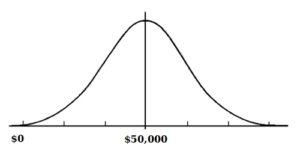

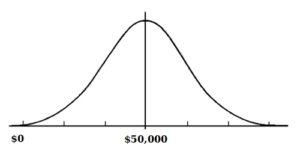

Confused about how normal distribution in CPCU® 500 works? You are not alone! This tip will help shed some light on this tricky concept.

Normal distribution (also known as standard distribution) simply refers to one of the most prevalent data patterns, where the most commonly-occurring value is in the middle of the graph and then the frequency tapers off at either extreme end. For example, if you are looking at home prices in an area, there will be a lot of homes around the average price, which is somewhere in the middle of the graph. Then, as you look for homes that are cheaper and cheaper, or more pricier and pricier, there will be less and less homes available as you go lower or higher in price. In other words, your graph might look something like this:

(more…)

by Stacy T. | Feb 23, 2018 | CPCU 520

The actuarial chapter of CPCU 520 introduces three different rate-making methods that insurance companies use to decide what rates to charge for their insurance products. The goal of this tip to explain the methods in a more simplified manner, so that they are easier for you to understand and memorize.

(more…)

by Stacy T. | Feb 15, 2018 | CPCU 530

Of the many ways to legally terminate a contract, CPCU 530 discusses the concept of impossibility and how that differs from frustration and impracticality. This tip will explore the differences between the three in more detail and provide examples to help improve your understanding.

(more…)

by Stacy T. | Feb 8, 2018 | CPCU 540

One of the key concepts you will be studying in CPCU 540 is zero-coupon bonds. Here is the difference between a regular bond & a zero-coupon bond:

When you buy a regular bond, you pay the face value for it. While you own the bond, you’ll get interest paid to you periodically until the maturity date, at which time the face value gets paid/returned to you. As such, your earnings or profits come from the interest you get paid. So, let’s say I buy a $100 bond for $100, I get $5 a year for 3 years, then I get my $100 back at the maturity date – my profit is $15 (from in interest).

(more…)