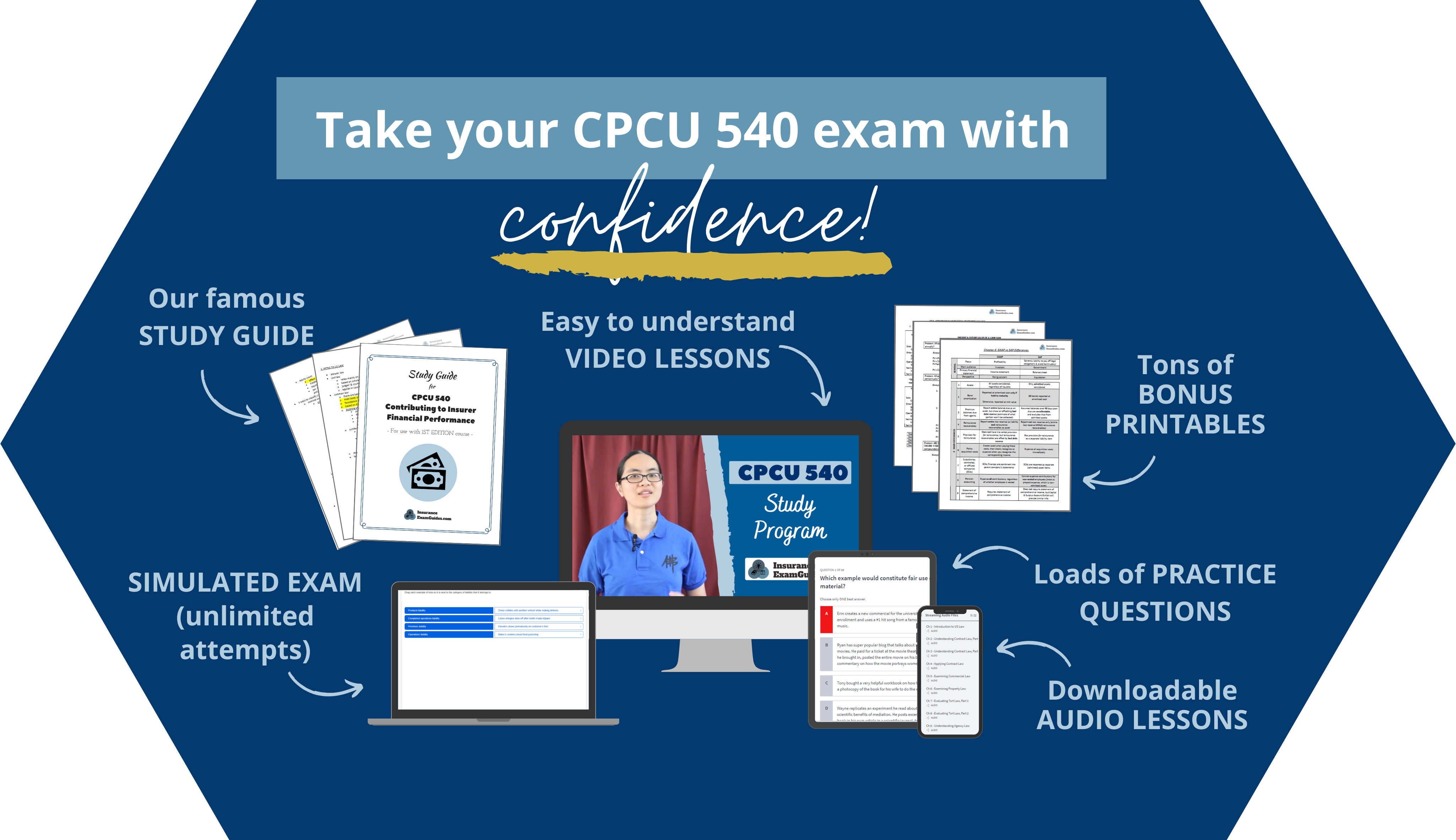

We’ve loaded our online course with tons of content to help you grasp all the tricky concepts:

Online Video Lessons: CPCU 540 is a course that is best learned with visual aids. We show you how concepts work, and work out the various word problems you’ll encounter step-by-step, with helpful annotations and tips for avoiding the most common mistakes. If you prefer to read the content, our platform displays captions and full, searchable transcripts.

Streaming Audio Option: If you prefer to learn on the go, our streaming audio option lets you listen to the lectures while you commute, workout, or otherwise have time to listen in.

Study Guide Outlines: Our famous study guides condense each chapter to several pages of key terms, major concepts, and other important lists of information. The clean outline format makes it easy to see how the details presented are related to each other.

Introductory Lessons: Based on our popular blog post series CPCU 540 Fundamentals, we have included lessons on topics that we think you should understand before you start reading your textbook. These lessons cover topics that are referred to all thorough the book from start to finish, but aren’t explained well right off the bat. If you don’t know these concepts upfront, you might not fully grasp what is being said every time the textbook makes mention of them. We help you solve that problem by teaching you these concepts right upfront.

Help with Formulas: CPCU 540 is notorious for the many, many formulas covered that aren’t all provided for you on the exam. Our e-bundle includes a number of tools to help you:

- Formulas Module, that explains each formula in detail

- Convenient, quick reference sheets that list out the formulas

- “How to Memorize CPCU Formulas” handout, outlining a method that allows you to create a cheat sheet for yourself on test day.

How to Solve GAAP Problems: One of the trickiest elements of the CPCU 540 test is understanding how to read GAAP statements and draw conclusions. Because what constitutes “good financial results” is relative depending on the company and their situation, there aren’t that many hard and fast rules about what to look for. We compiled a list of tips on how to navigate solving GAAP problems, and give examples for you to see how those tips apply.

GAAP vs SAP Table: Prior test-takers consistently mention that the test will include questions about the differences between these two accounting methods. We provide a convenient table that shows the main differences side-by-side, so you can easily compare and contrast them at a glance.

IRIS Ratios: One thing you’ll learn about in CPCU 540 is how government regulators monitor insurance companies’ performance to ensure that the insurers don’t go bankrupt. Our quick reference sheet lists out all the IRIS ratios, what they tell you, and what the government’s acceptable values are for those ratios.

Practice Problems: The old saying “practice makes perfect” is absolutely true when it comes to CPCU math problems, so we have a whole bunch of extra problems for you to practice on. We even included walk-throughs for all the variations of the cash flow valuation problems, showing you how to use the tables that will be provided to you on the test.

Chapter quizzes: Reinforce your understanding by taking the practice quiz that comes at the end of each chapter.

Full-length practice exam: Our final exam draws on the content from every chapter, so you can get a sense of what it’s like to be tested on everything at once.