The Institutes has released an updated version of CPCU 500, with a new course title: CPCU 500: Becoming a Leader in Risk Management and Insurance. Keep scrolling to see our full review and a list of how the topics have changed.

Summary of changes:

- Chapters that have been completely removed (but we suspected much of this may have been relocated to CPCU 550):

- Chapter 1 (various types of technology)

- Chapter 3 (identifying & analyzing risks)

- Chapter 8 (strategic risks)

- Chapter 9 (statistical concepts relating to risk modeling)

- Chapter 10 (big data)

- New chapters added:

- Chapter 1: [misconceptions about insurance & challenges that insurers have faced]

- Chapter 4: [various types of personal & commercial insurance]

- Chapter 5: [critical thinking]

- Chapter 7: [strategic management; from CPCU 520 chapter 10]

- Overall focus of course has changed (no longer as focused on risk management; serves more as an introduction to insurance)

- Issues with practice quizzes

- Multiple instances of jargon & terms that aren’t fully explained

- Major changes to simulated exam

Exam information:

- For third quarter (Q3) test window: Exam is based on the expiring version of the course, CPCU 500: Managing Evolving Risks. The last day to test on this version of the exam is September 15, 2023.

- For subsequent test windows: Exam will be based on the new version of the course, CPCU 500: Becoming a Leader in Risk Management and Insurance .

Details of overall changes:

1) Improved visual look: The new interface is more colorful and visually appealing.

2) Improvement to word choice: Most of the wording in the new course is much simpler and easier to understand than before, with the exception of chapter one.

A big complaint about prior courses was that the wording was too verbose and used overly complex word choices that were not necessary, which made it more difficult to follow along and stay attentive. In the newer version of the course, The Institutes did a good job of improving the wording with the exception of chapter one, which still felt a little more verbose than necessary.

3) Majority of content is still text: About 80% of the course content is still text-based, meaning you still have to do a lot of reading.

This is very surprising because The Institutes had stated on their CPCU FAQ page that “the learning experience is being updated to match the needs of today’s busy adult learner—including more videos and interactions to help students acquire and retain the skills they need to be leaders.” We did not find any interactive modules within the assignments themselves, and the practice quizzes & practice exam did not appear to have any changes. The only portion of the course that included a new style of activity was the simulated exam, which we discuss in further detail in #8 below.

On a side note regarding the video content: you do have the option to turn on captions and change the speed of the video. We found the videos much easier to watch at a faster speed and with the captions on.

4) Extensive content changes: Nearly all content on data and technology has been removed, and lots of introductory level content has been introduced

Of all the core CPCU courses, CPCU 500 has had the most content change. There were more removed chapters and more new chapters than what we saw with other core course. We do suspect, though, that the removed chapters (which mostly relate to technology & data analysis) have most likely been relocated to the new CPCU 550 course. After we have a chance to review that course, we will update this post as appropriate.

5) Overall focus of course has changed: The course is no longer as focused on risk management, and serves more as an introduction to insurance.

The expiring version of CPCU 500 focused heavily on identifying and analyzing different types of risk, making it particularly helpful for aspiring risk management professionals. Now, the course provides a much more cursory look at various types of risk, most of the analysis content has been removed, and new chapters have been added that provide an overview of the most common types of personal & commercial insurance. This makes the course feel more like a general introduction to insurance, rather than being so focused on risk management.

6) Issues with practice questions: Several errors found in practice quizzes.

In the practice quizzes for chapter 1, we found numerous questions that pertained to chapter 6.

In the practice quizzes for chapter 3, we found questions relating to key risk indicators, a topic that was covered in the expiring version of the course but was removed in the newer version.

We have emailed The Institutes to report these problems.

7) Use of jargon & terms that aren’t fully explained: There were several instances throughout the course where a technical term was mentioned but never defined.

In several cases, The Institutes’ course gave an example to illustrate a concept, but the example was something fairly technical in nature that was never fully explained anywhere else in the course. For example, the course referred to things like captive insurers, risk retention groups, and parametric insurance without ever elaborating on what those things are. In the expiring version of the course, many of these terms were discussed in more detail at some point, so it is possible that when The Institutes decided to remove those particular key terms, they forgot to remove all mentions of those concepts in other places within the course.

Granted, we did not see any questions that tested you on your knowledge of those undefined concepts, but it does make those examples less helpful for improving your understanding of the main concept that is being illustrated.

8) Simulated exam:

In the newer course, the simulated exam uses the same interface as the actual exam, so it does a much better job of mimicking the true exam experience.

More importantly, the simulated exam included non-multiple choice questions, such as type-in-the-blank, drag-and-drop, and multi-choice multiple choice questions (where more than one of the answer choices is correct). For a detailed discussion of these question types, see our post Virtual exam information.

We did email The Institutes to inquire if the actual exam will include these new question formats, and they responded that “No changes have currently been made to designation credentialing exams or the corresponding grade reports.”

One more thing worth noting about the simulated exam is that once you finish the test, review what you got wrong, and close out of it, you can no longer access the exam attempt again to re-review the questions.

List of topics covered:

The list below shows the main topics covered in the expiring course, CPCU 500: Managing Evolving Risk. We have noted what topics have been removed and where the remaining topics appear in the new version of the course in the following manner:

- Sections that do not appear in the newer course with the same level of detail are stricken out (in some cases, minor references to the same topics may still appear in the new course in other places)

- Which chapter each topic can be found under in the new course

- List of new topics that are not covered in the expiring course

Note: We do not provide any guarantees or warranties regarding the accuracy and comprehensiveness of this list.

Chapter 1: [various types of technologies]

Basic risk related termsBig dataRisk techTypes of technologiesSmart products & smart operations

Chapter 2: [risk management foundations]

- Risk management process [Chapter 2]

- Ways to classify risks [Chapter 2]

Objectives of enterprise risk management (ERM)Basic risk measures

Chapter 3: [identifying & analyzing risks]

- Enterprise risk management (ERM) [Chapter 2]

Measuring risk variablesTeam-oriented risk identificationRisk analysisTheories to accident causationRoot cause analysis

Chapter 4: [risk treatment & technology]

Risk treatment techniquesProuty approachImpact of technology- Using insurance to treat risks [Chapter 4]

- Non-insurance risk transfer [Chapter 3]

Large deductible plans

Chapter 5: [hazard risks]

Natural disaster loss controlLife safety- Valuing physical property [drastically simplified; Chapter 4]

- Management liability risk [Chapter 3]

- Human resource (HR) risk [Chapter 3]

Chapter 6: [operational risks]

- 4 categories of operational risks [Chapter 3]

Operational key risk indicatorsRisk assuranceRisk monitoring & reportingEmerging tech for managing risk

Chapter 7: [financial risk]

- Types of financial risk [Chapter 3]

Balance sheetSecuritization

Chapter 8: [strategic risk]

Strategic risk factorsAssessing strategic riskStrategic management processIncorporating risk into strategiesApplying strategic risk management principles

Chapter 9: [risk modeling]

ProbabilityProbability distributionsVolatilityNormal distributionsValue at risk / earnings at riskTrend analysisAnalyzing event outcomes

Chapter 10: [data & data analysis]

Characteristics of dataInternal vs external dataBig data categories / examplesTraditional data analysisModern data analysisData driven decision making

Chapter 11: [working with others]

- Effective communication [Chapter 6]

Risk management collaboration- Effective collaboration [Chapter 6]

Collaborating with expertsHow to deliver a message- Leading effective meetings [Chapter 6]

Modes of persuasionResolving communication problems

[new topics]

- About the insurance industry [Chapter 1]

- How insurance benefits society

- Common misconceptions about insurance

- Challenges faced by insurers

- Insurance career opportunities

- Property loss exposures [Chapter 3]

- Liability loss exposures [Chapter 3]

- (overview of various commercial liability exposures) [Chapter 3]

- (various types of personal & commercial insurance) [Chapter 4]

- Homeowners insurance

- Personal auto insurance

- (other types of personal lines insurance)

- (types of commercial insurance)

- Building & personal property (BPP) coverage

- Equipment breakdown coverage

- Business income coverage

- Inland marine coverage

- Commercial crime insurance

- Commercial general liability (CGL) coverage

- Employers liability coverage

- Critical thinking [Chapter 5]

- Key stages of the critical thinking process

- Critical thinking across the insurance value chain

- Applications for critical thinking

- Selecting the best form of communication [Chapter 6]

- Strategic management [Chapter 7; from CPCU 520 chapter 10]

- Strategic management process

- Five Forces Model

- SWOT Analysis

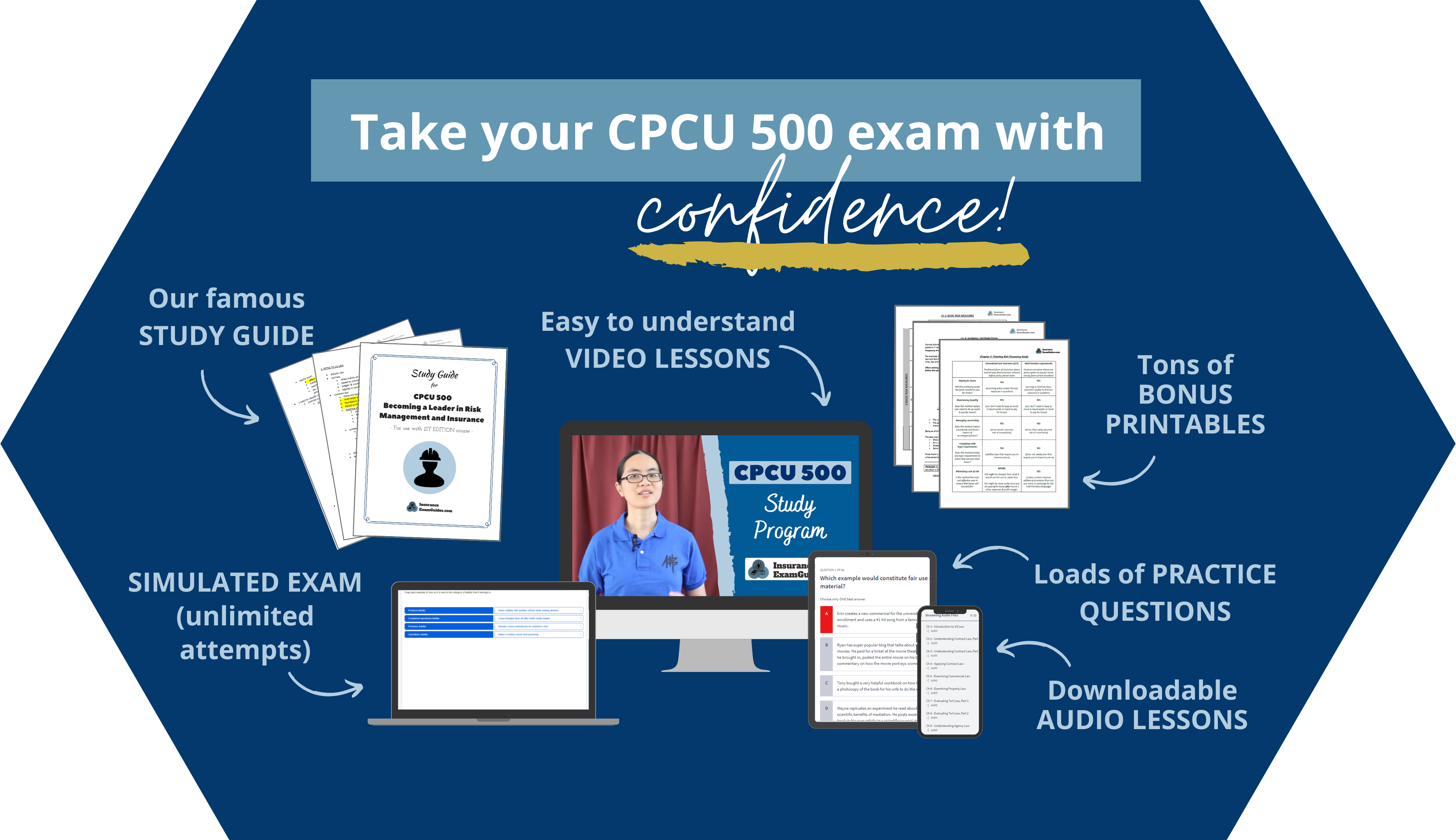

Frequently asked questions (FAQ) for IEG products

Which course version is IEG products based on?

- We have updated our study materials to reflect the new course. When clicking the “Buy Now” button, the updated study materials will be added to your shopping cart.

- All students who are enrolled in the expiring version of our study program can request a free upgrade to the updated version by emailing us at info@insuranceexamguides.com

How can existing customers get access to the new study materials?

- If you bought a study guide bundle: Use the download link you received in your order confirmation email to download both versions. We have also emailed all prior customers with these same instructions.

- If you bought an online study program: Please email us at info@insuranceexamguides.com from the email address you use to sign on to request enrollment in the updated study program.

Join our mailing list to get notified when the new course is available!

Get a free study plan generator and CPCU progress tracker!

Join our mailing list and score these free tools.

Get Your CPCU 500 Study Materials NOW!

Looking for our printables-only package? Click here.

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.