Earning your CPCU® designation can help you advance your insurance career, but the required courses can be quite challenging. In this post, we’ll go over everything you need to know about the CPCU 520 course and give you tips on how to pass this exam.

What’s in this post

What is the CPCU program?

The Chartered Property Casualty Underwriter (CPCU®) is a professional designation offered by an organization called The Institutes. After completing the program, you will have a solid understanding of how insurance industry works and can display the CPCU designation on your business cards, resume, etc.

Having this designation shows that you have done extra education, which can make you a stronger candidate for hire or promotion. Also, this might give customers, colleagues, and business partners more confidence in working with you because they know you have this foundational knowledge.

What is CPCU 520?

CPCU 520 is one of the five core courses that you must complete if you are following the traditional path to earn your CPCU designation.

This particular course is about how the different departments within an insurance company operate and how they support each other to collectively ensure the insurer’s success. This knowledge will help you understand how an insurance company functions, how the industry is regulated, and what kinds of business strategies an insurer can pursue.

How hard is CPCU 520?

Some students find CPCU 520 to be quite challenging because it does contain some very technical content, especially in the chapters that deal with the actuarial function and reinsurance. There are also a bunch of formulas that you’ll need to remember and learn how to apply.

Overall, we would say that this course has a slightly higher-than-average difficulty compared to the other CPCU courses. You can improve your chances of success with the right study strategies; check out our best tips on how to tackle CPCU 520 in a later section below.

About the CPCU 520 exam

In order to demonstrate that you have understood the material from this course, you will need to pass an online exam administered by The Institutes.

You must go through The Institutes' website to purchase and formally register for your exam. When registering, you must indicate which test window you plan to take the exam during. The four test windows that are available every year are:

- January 15 to March 15

- April 15 to June 15

- July 15 to September 15

- October 15 to December 15

You may pay for your exam fee at any time, and those who register before the test window opens will usually receive a discount. However, you can only launch the exam and complete it during the test window you chose at the time of purchase. If you need to reschedule your exam, a new fee will apply.

The exam consists of 50 questions that cover all the chapters from the course, with a time limit of 65 minutes. The exam is done online, and you must get a score of 70% or better to pass. You may retake the exam (and pay a new fee) if you do not pass, but please check The Institutes' policies regarding how often and how soon you can retake the exam, as that may change from time to time.

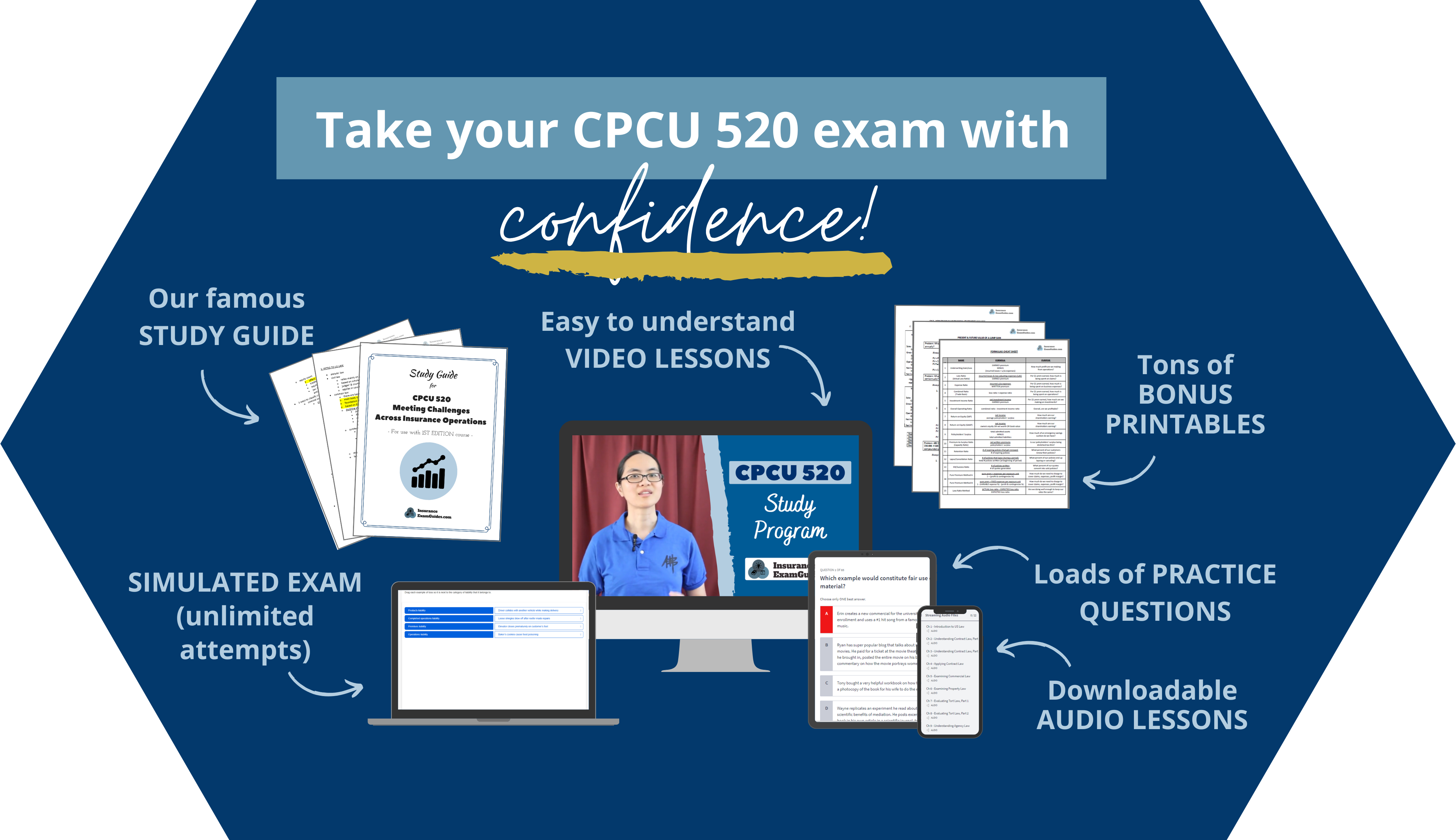

Get Your CPCU 520 Study Materials NOW!

Looking for our printables-only package? Click here.

Topics covered in CPCU 520

- Insurance regulations

- Marketing insurance

- How the underwriting department works

- How the claims department works

- How the actuarial department works

- Reinsurance

- Analyzing financial statements

- Vertical and trend analysis

- Underwriting for personal lines

How IEG can help: We have a comprehensive study program that covers every chapter from CPCU 520. We use plain language and effective illustrations to help you truly understand the content. We also provide our famous study guide that allows you to easily and efficiently review all the material.

Topics you are most likely to see on the CPCU 520 exam

The following list is based on student feedback regard what topics were most heavily-featured on their exam.

Please remember that this is not a comprehensive list of all the topics that will be tested, and each person’s exam may different. Any of the material covered in the course may potentially appear on your exam, so you should prepare accordingly.

- GAAP ratio formulas

- Types of underwriters

- The underwriting process

- Marketing-related vocabulary terms

- The goals of each department/function within an insurance company

- Ratemaking concepts

- Calculating how much will be covered under a reinsurance policy

How IEG can help: Our CPCU 520 online study program includes extra-detailed explanations of all of these topics. We also provide tons of practice problems so you can get the hang of how to do all of the necessary calculations.

Tips for passing CPCU 520

1) Go through your course material twice

CPCU 520 basically breaks down each department within an insurance company and explains what each one does in great depth. While you are going through each chapter, there will often be discussions about how that department affects other departments. During the earlier chapters, you might not fully comprehend all of nuances because you don’t learn about that other department until later in the course. After you finish going through the material the first time, you will have a pretty good understanding of what each department does, so when you go back through the material a second time, all of those references to other departments will make total sense.

2) Memorize the CPCU 520 formulas the easy way

While there is debate about whether or not it is necessary to memorize the formulas, many students find that it gives them a boost of confidence that is very comforting. Memorizing the formulas from CPCU 520 can seem very daunting, but it’s totally doable if you have a system. Every day, focus on memorizing just one new formula, then practice writing down all the prior formulas you learned plus the new formula from that day. When it comes to test time, take a moment at the start of the exam to write down all the formulas you memorized onto your scratch paper, which should be easy to do because you have been practicing. By doing this, you will have a handy cheat sheet AND can free your mind to concentrate on the test.

Keep in mind that simply memorizing the formulas is not enough. You need to understand what the formula is intended to measure and how to interpret the results, so you should practice doing the calculations and be able to explain what the results are revealing.

How IEG can help: Our online study program discusses every formula from the course in great detail, with step-by-step explanations of how to do the various calculations. We also provide plenty of practice problems to help you make sure that you have truly grasped the material.

3) Learn how to calculate what is covered under a reinsurance policy

In chapter 6 of CPCU 520, you will learn about reinsurance and how insurers can use this type of policy to have someone else pay for the claims that the first insurer has agreed to cover for their own customers.

You are almost certain to get exam questions that give you a scenario and ask you to calculate how much premium the insurer has to pay under the policy or how much of the insurer’s losses will be covered under the reinsurance policy. Be sure to do lots of this type of practice problem because you are bound to encounter it on your exam.

How IEG can help: Our CPCU 520 study program comes with detailed video lessons that walk you through exactly how to solve reinsurance problems. We also provide plenty of practice problems to help you make sure that you have truly grasped the material.

4) Spend time to master the calculation-based questions

Students are often intimidated by exam questions that require them to apply a formula or otherwise calculate a number, but we believe that it is actually ideal to encounter these types of questions on the exam because you will know pretty much right away that you got it correct if the result you got is one of the answer choices. Knowing that you scored those points can help you move through the rest of the exam with a boost of confidence.

In CPCU 520, the main chapters that will include formulas and calculations are chapters 3 (analyzing ratio formulas), 7 (actuarial calculations) and 8 (reinsurance).

5) Don’t waste too much time on long questions or questions that you are stuck on

Every test question is worth only one point, no matter how simple or complex it is. If you find that you are spending a lot of time on one particular problem, you are better off guessing for now and using the option to flag the question so you can return to it later. You don’t want to spend so much time that you run out of time before you can get to all the other questions that might have been easier for you to score points on.

6) Put an answer for every question

You do not get minus points for getting a question wrong, so don’t leave any questions blank.

CPCU 520 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 520: Meeting Challenges Across Insurance Operations (1st edition)

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

7) Get as much practice as possible

The best way to ensure that you know how to apply the concepts you learning is to practice doing so, and practice quizzes are the perfect way to do this.

Our online study program for CPCU 520 includes tons of practice questions, as well as a simulated exam that you can reattempt as many times as you want.

The Institutes’ online course also includes practice quizzes and a simulated exam, but you are only allowed one attempt at the simulated exam and you cannot review your answers once you close that browser tab. The Institutes used to have a Smart QuizMe app that also provided practice questions, but they have since removed the question banks for all the current CPCU & AINS courses from the app. At this time, we do not think that The Institutes will be updating their app to include new CPCU & AINS question banks, since The Institutes has not announced any specific plans to do so.

8) Aim to understand the practice questions and not just memorize them

The questions on the actual exam are not made up of the practice questions, so you cannot just rely on memorizing those answers for any practice quizzes and simulated exams you take. Read each explanation and re-review the material until you understand why you got a question wrong.

9) Don’t rely solely on The Institutes’ study materials

The Institutes’ way of explaining things is not necessarily the best way, so take advantage of other resources available to you. Some students don’t use The Institutes’ study materials at all and prefer to go with another study option, such as our comprehensive online study programs. We use plain English to explain all of the concepts, include helpful illustrations that help you see how a concept works, and show you how different elements of something relate to one another.

You can also turn to Google and YouTube to look for explanations and examples from other sources too.

10) Join the CPCU Candidates Facebook group

One of the best things you can do during your CPCU journey is to join the CPCU Candidates Facebook group, which is a wonderful community of current and former CPCU students. Here, you can get help with test questions that might be stumping you, ask for advice on propelling your insurance career, and find a healthy dose of moral support and motivation.

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get Your CPCU 520 Study Materials NOW!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.