CPCU 540

Contributing to Insurer Financial Performance

Topics covered:

Learn about financial concepts that pertain to the insurance industry.

- GAAP reporting standards

- SAP reporting standards

- Financial statements (balance sheet, income statement, statement of changes in shareholders’ equity, cash flow statements)

- Financial issues unique to insurers

- SAP financial ratios

- Insurance Regulatory Information System

- AM Best financial ratings

- Time value of money

- Bonds and stocks

- Generating capital

- Risk-based capital (RBC)

CPCU 540 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 540: Contributing to Insurer Financial Performance (1st edition)

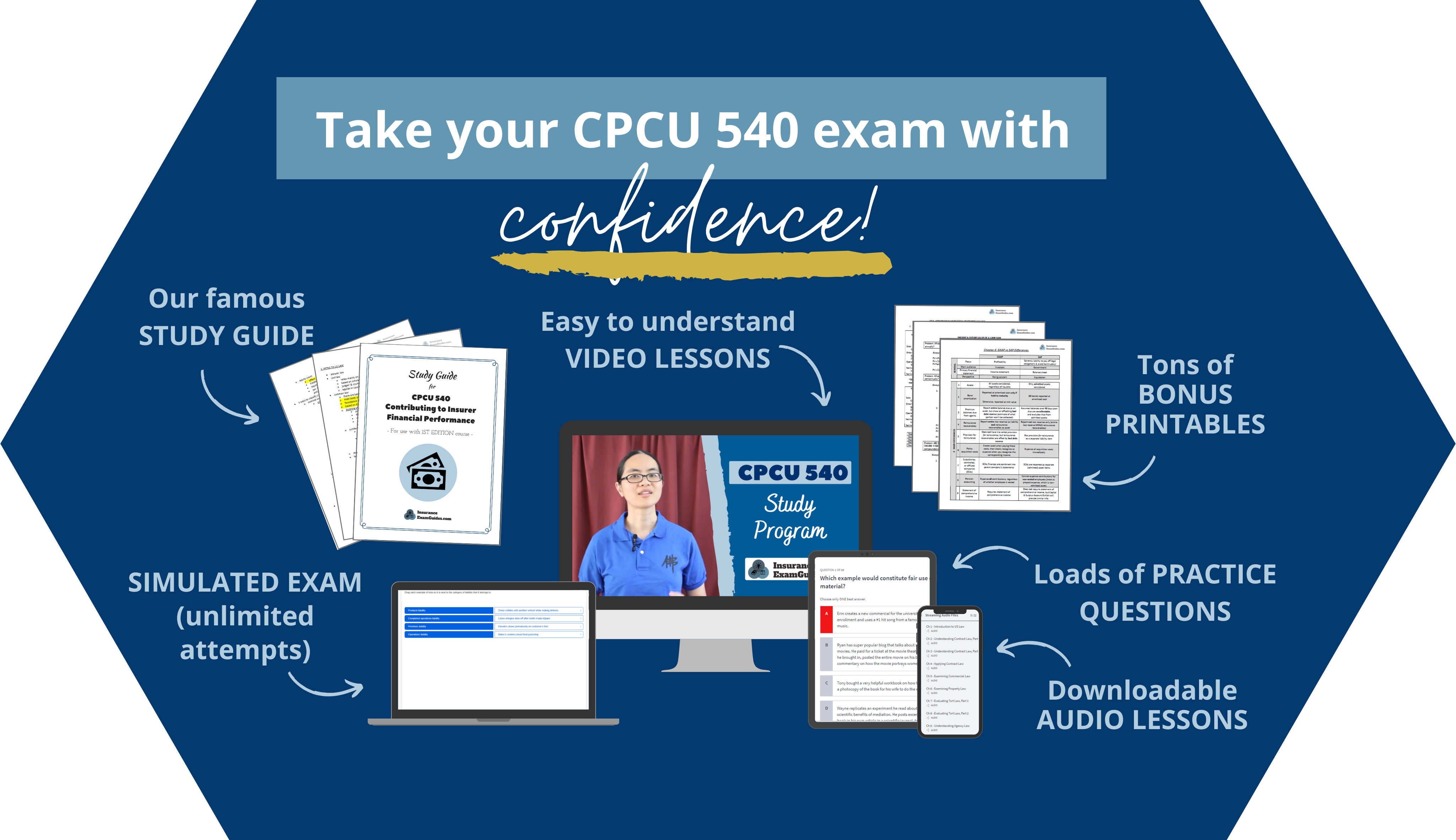

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

What you get with our study programs:

Full video library

Our videos lessons cover all the key concepts, using simple language and helpful illustrations

Audio lessons

Stream or download our audio-only lessons and learn on the go

Printables bundle

Includes our famous study guides and all the printables listed below

Chapter quizzes

Our practice questions include detailed explanations of which answer is correct and why

Simulated exam

This timed exam includes fill in the blank, drag and drop, and multiple choice questions, so you'll be prepared for what the real exam feels like

Searchable video transcripts

Read any video's content and jump right to specific video sections

CPCU 540 printables include:

Comprehensive study guide: Condenses each chapter down to several pages, listing out all the key terms, major concepts, and other important lists. The outlines include the technical definition for each concept, a simpler definition in plain English, and examples to illustrate the trickier concepts.

Introductory Lessons: Having a certain amount of background knowledge will greatly improve your comprehension as you go through the CPCU 540 content. We think you should understand these concepts before you dive into the course material, otherwise you might not fully grasp what is being said every time the course material makes mention of them. We help you solve that problem by teaching you these concepts right upfront.

Formulas Module: Understanding how to apply the formulas you will learn about is a must if you want to pass your exam. Our formulas module explains exactly what each formula tells you, and uses simple examples to illustrate how to interpret the results you get after applying the formula. Includes cheat sheets plus general tips for mastering formulas.

IRIS Ratios Reference Sheet: IRIS ratios are used specifically to analyze the performance of insurance companies. This quick reference sheet lists all the ratios on one page, with a short summary of what you can tell by applying that ratio and what value is considered acceptable.

GAAP vs SAP vs IFRS Reference Sheet: Insurers use up to three different sets of standards to format their financial statements. This chart helps you easily see the differences between all three.

Time Value of Money Practice Problems (with walkthroughs): One major component of the exam will be solving present or future value (PV/FV) problems. We’ll give you step-by-step instructions on how to solve these problems using the provided tables or using a financial calculator (HP 10bII or TI BAII). That way, you can compare the methods and decide which one is right for you!

Annual Rate of Return: This printable shows how to calculate the rate of return that you received on an investment. Includes tips on common mistakes to avoid.

Measures of Variability: Choosing the best investments requires you to evaluate how consistent their returns are. See detailed walkthroughs showing you to calculate the various formulas used to calculate variability.

ENROLL NOW

Get all the tools you need, study at your own pace, and ace your exam!

How we compare to The Institutes (CPCU®)

Save BIG and get more features!

Insurance Exam Guides |

The Institutes

|

|

$169.99 |

$399.00 |

|

| Length of access | No expiration date | One year from purchase date |

| Video lessons | Full video library | Some videos (most lessons are text-only) |

| Searchable video transcripts (read the content and jump to specific video sections) |

✓ | |

| Downloadable audio lessons (streaming option also included) |

✓ | |

| Chapter quizzes | ✓ | ✓ |

| Simulated exam (timed) | Unlimited attempts | One attempt |

| Study guide | Comprehensive study guide | Basic chapter outlines |

| Course updates | Free lifetime updates (when we update our content, you get the new material at no extra cost) |

No free updates (you must repurchase to get updated content) |

Free preview lesson:

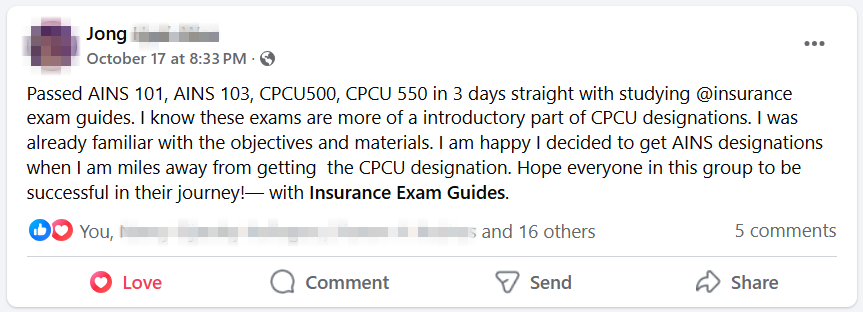

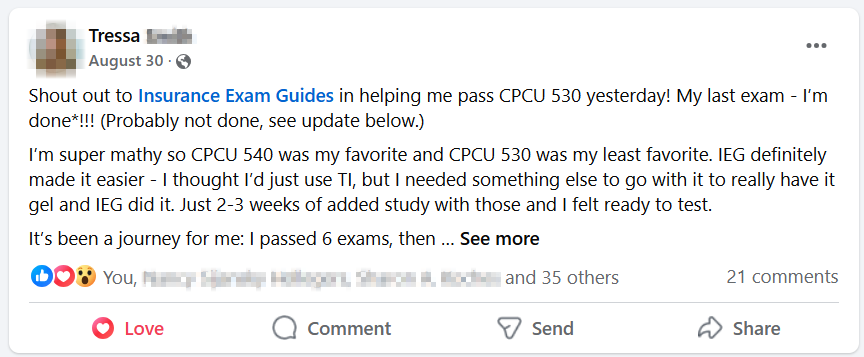

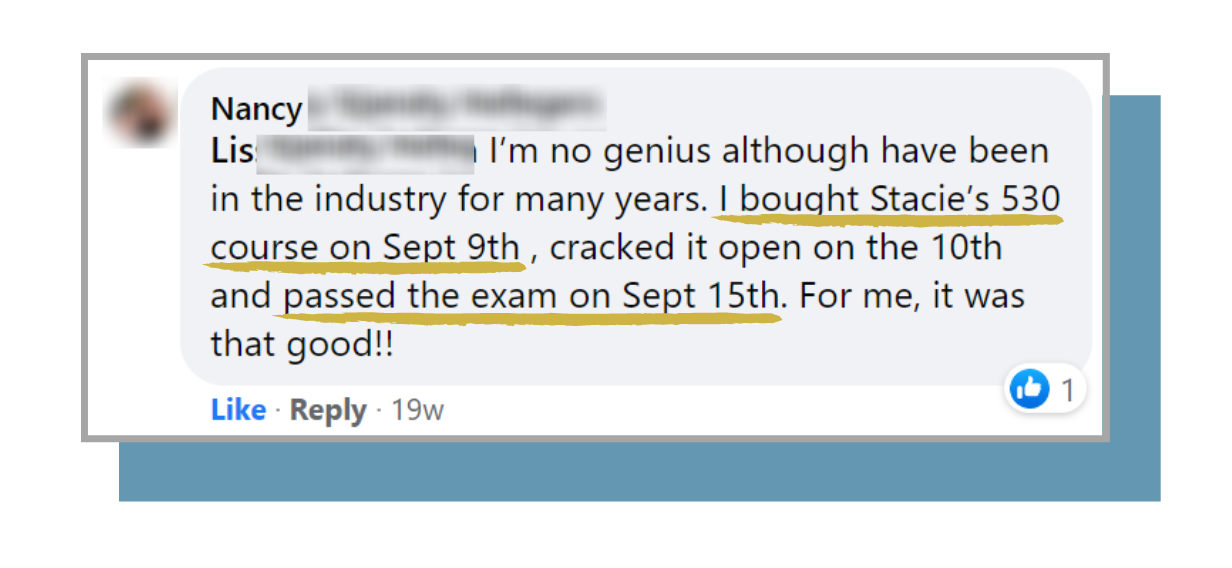

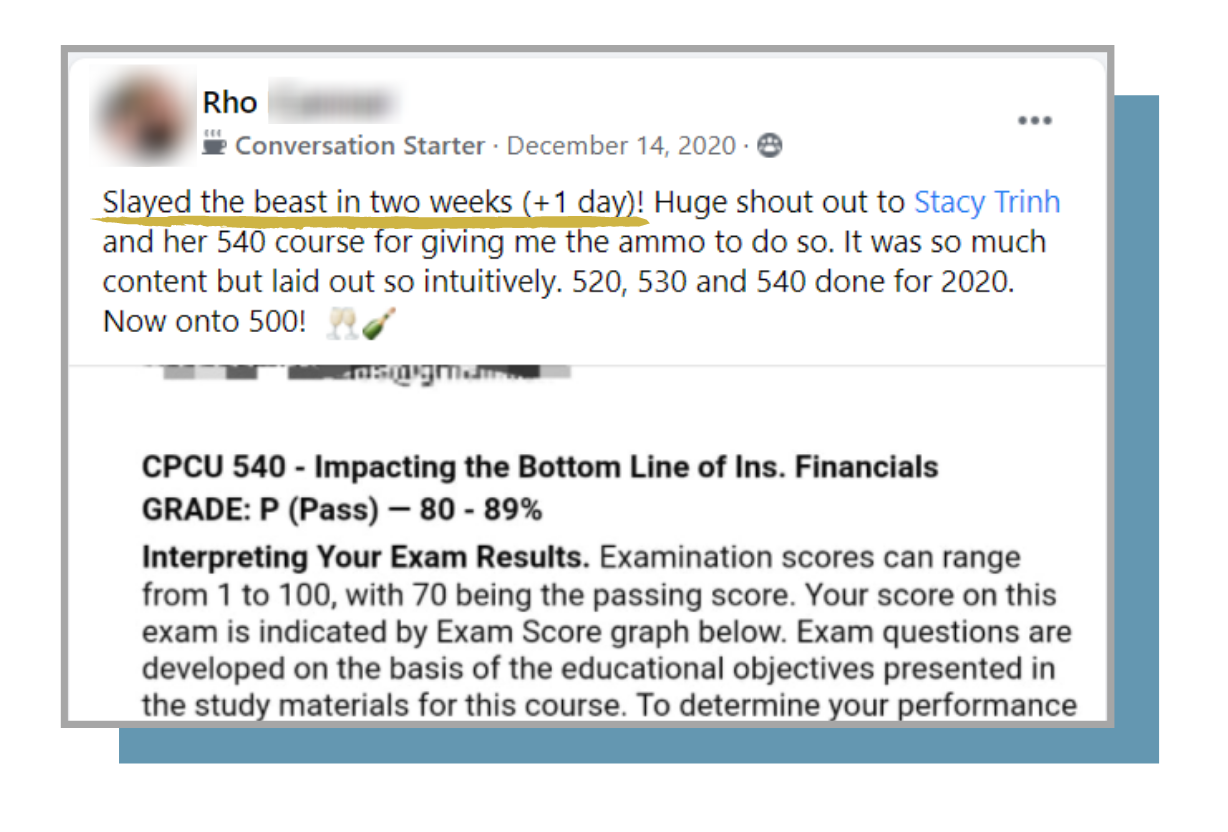

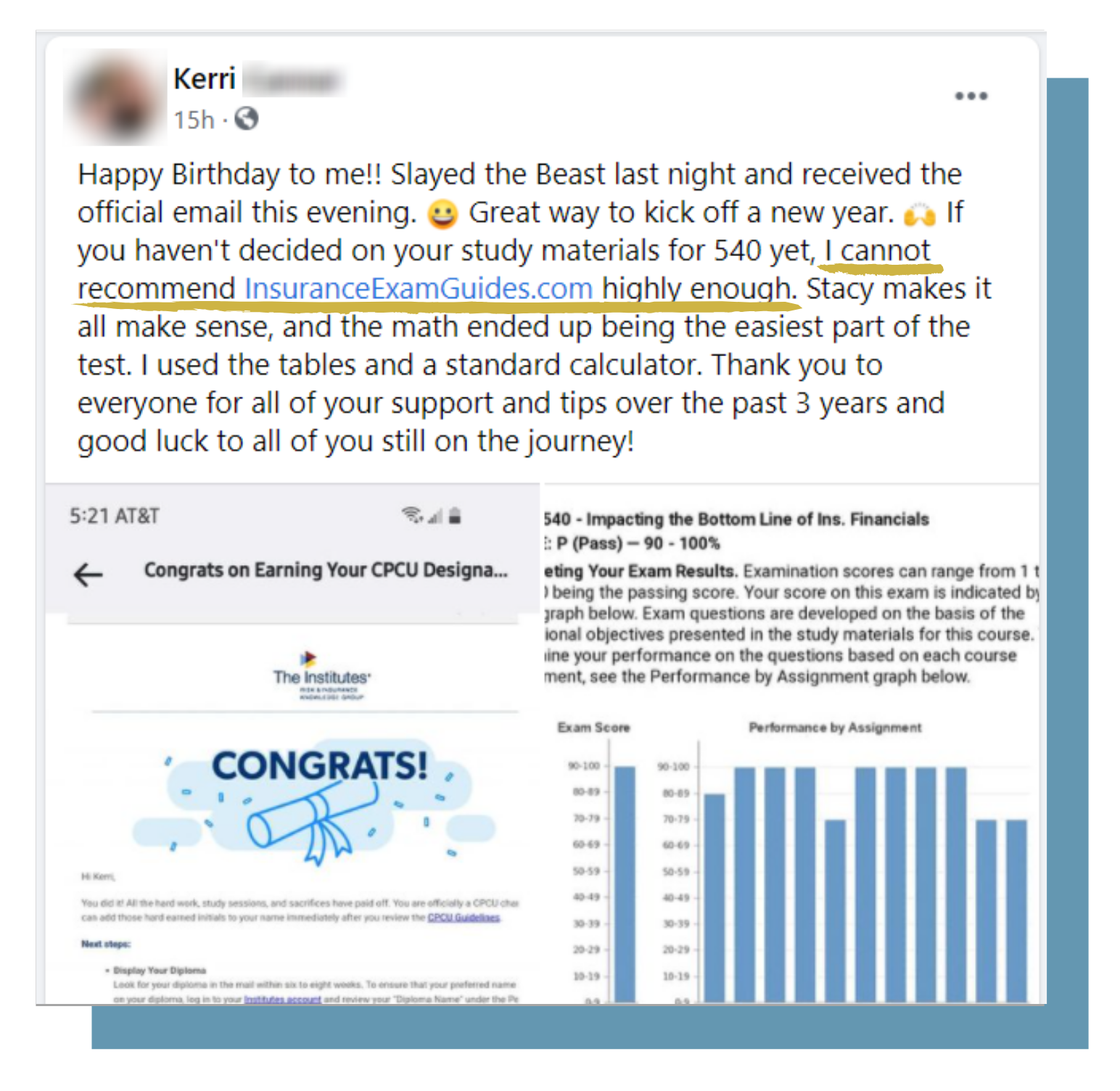

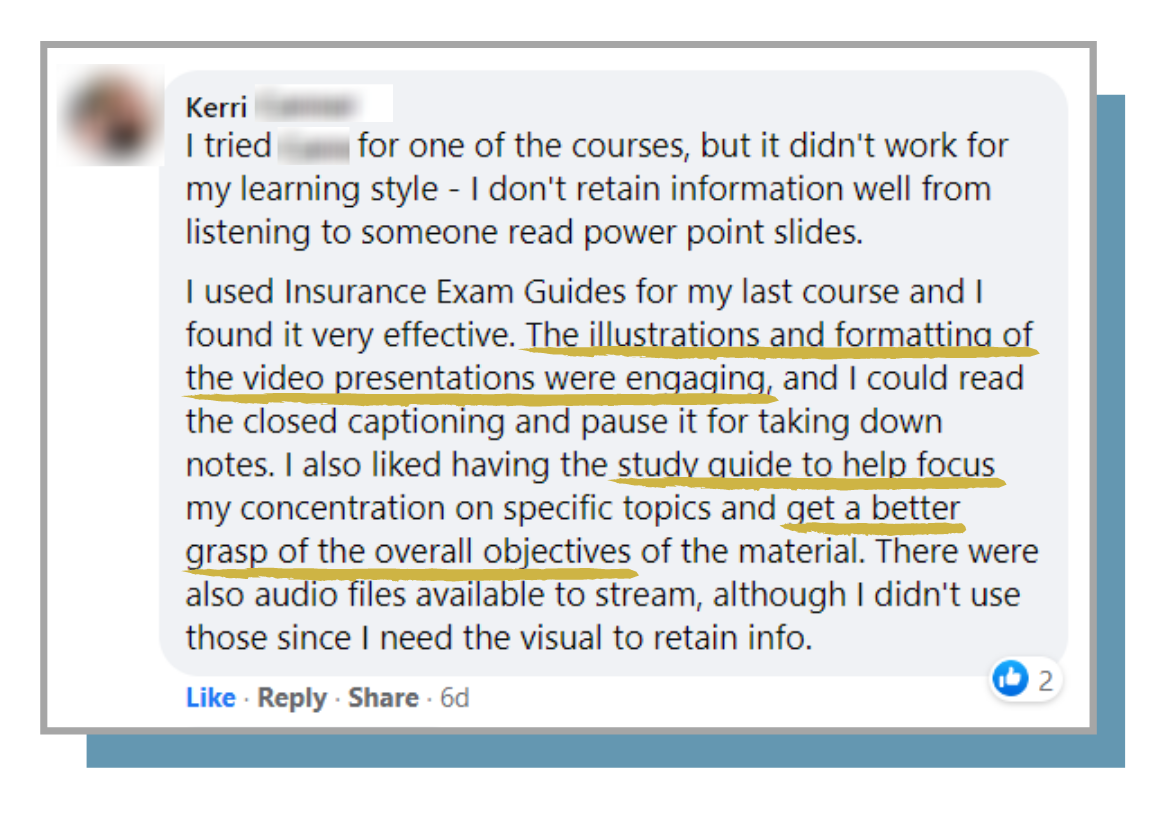

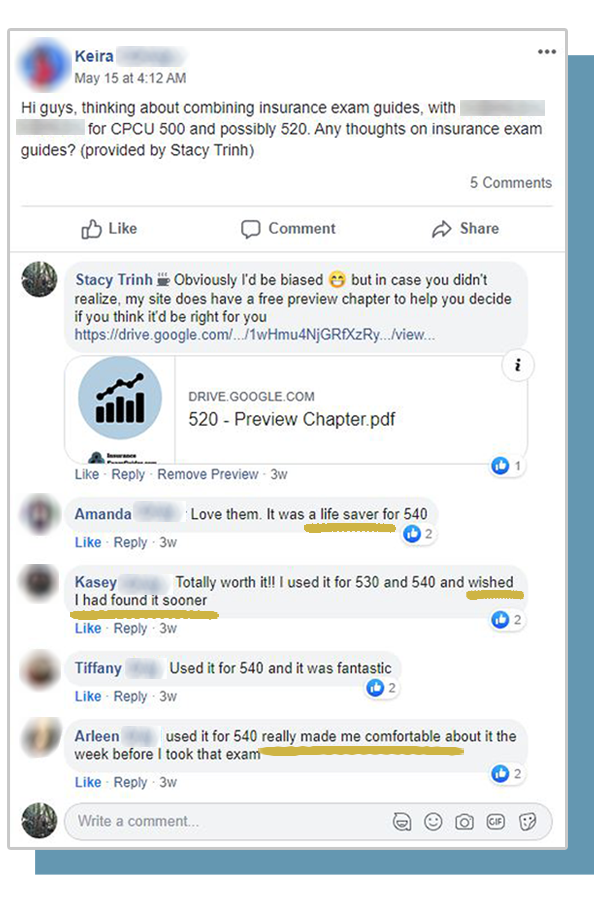

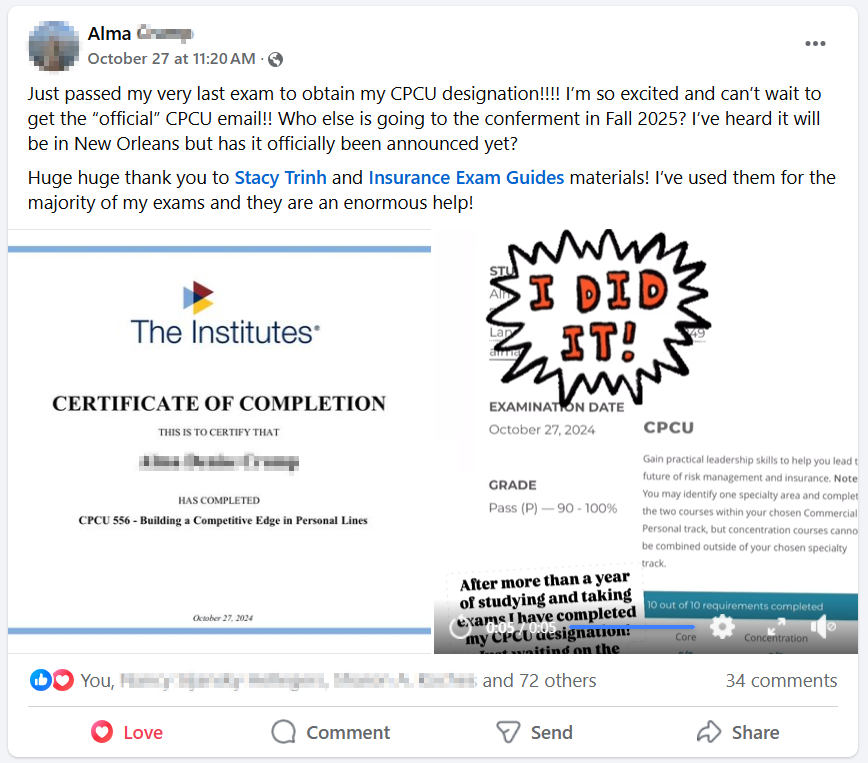

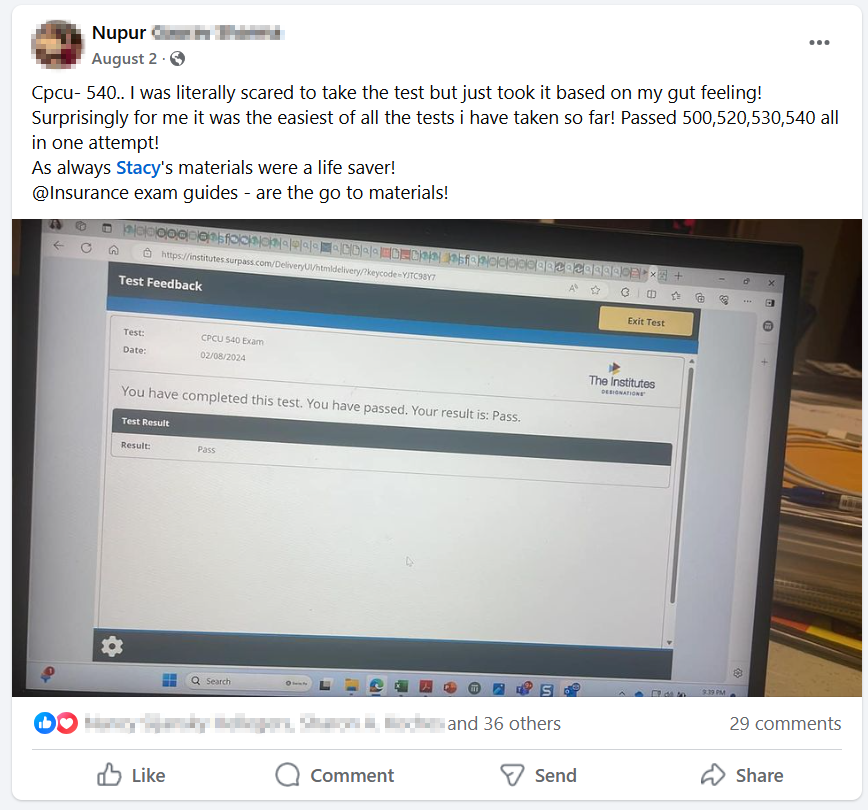

STUDENTS LOVE OUR STUDY MATERIALS!

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.