Many insurance companies provide incentives to encourage their employees to pursue the CPCU® and AINS® designations. For companies that don’t, their employees don’t have to assume that their workplace is not willing to provide support in some way. In this post, we’ll talk about how to ensure that you are utilizing all the CPCU or AINS benefits your workplace has to offer, and how to ask your employer to consider providing benefits if they don’t already do so.

Topics covered:

- Find out if your company covers more than just exam fees & textbooks

- Tap into non-financial CPCU and AINS resources that your company may offer

- Get a CPCU Presidential Scholarship with the help of your workplace

- How to ask your workplace to cover your expenses if they don’t already offer it as an employee benefit

Ace your AINS® & CPCU® exams with the help of our study materials!

If Your Company DOES Cover Your CPCU or AINS Expenses

Some of us are fortunate enough to be working for a company that pays for its employees’ CPCU-related and AINS-related costs. However, you might be surprised to learn that some employers cover more than just the cost of the study materials & exam fees! Here are some other benefits that your workplace might already be offering to its employees:

- Study materials from a third-party company (such as ours!)

- Paid time off to take your exam

- Paid time off to study

- Matriculation fee

- CPCU Society membership fee

A CPCU Society membership is actually quite valuable, because the CPCU Society has a mentoring platform for its members, where you can sign up to be paired with a volunteer mentor. You can even specifically ask to be paired with a mentor who wants to focus on helping their mentees pass their exams! That gives you direct contact with someone who has been there, done that, and can serve as your private guide to success. The Society also host many events that are a great opportunity for networking. The best way to reap the benefits of your designations are to use them to meet more professionals and establish relationships.

But the CPCU Society is not the only place to find mentors–your company might be teeming with them! Remember that your workplace might also have sources of support that aren’t just financial: For example, you can approach other co-workers who’ve completed the CPCU or AINS programs to ask for mentorship, general advice, or even borrow their own study notes. Your workplace might also offer CPCU or AINS classes, either at your branch or another location. If the classes are not held at your office & there isn’t a way that you can remotely join-in, the chances are still pretty high that the instructor would be happy to share their handouts with you & help with any questions you have.

To find out about all the CPCU-related and AINS-related benefits your company offers, it is best to check multiple sources because you’ll rarely find a comprehensive list in just one place:

- Human resources (HR) department

- Other co-workers who have completed their CPCU or AINS program through your workplace

- CPCU or AINS instructors at your workplace

- Company benefits handbook

- Searching your company’s internal website

The point is, you won’t know everything your company that has to offer if you don’t take the time to go find out. Make the effort to inquire, then take advantage of all the CPCU benefits available to you!

CLICK HERE TO GET STARTED

If Your Company Does NOT Cover Your CPCU Expenses

Not all companies can afford to pay their employees’ ways through the CPCU or AINS programs, but that doesn’t mean all hope is lost! The Institutes generously awards their CPCU Scholarship to 100 nominees each year to help cover the costs of textbooks, course guides, study aids, exam fees, and the matriculation fee. Depending on whether you are being nominated by your workplace or by your college, the requirements will differ slightly.

For more details and to download an application form, visit The Institutes official scholarship page.

If you or your company does not meet the scholarship requirements, you can also consider just simply asking your workplace if they would consider covering your CPCU or AINS costs. Like with anything else, you won’t know if you don’t ask! The key to making a successful pitch is focusing on how it will ultimately benefit your company. For example: if your company is entering into a new line of insurance or struggles with a specific one, perhaps you can agree to focus your studies on that area & agree to transfer to that department afterwards. Or, you can offer to do training or classes for the rest of the staff on what you learned, so that your company is essentially paying for more than just one person to gain the knowledge.

And remember: it doesn’t have to be an “all-or-nothing” pitch–even getting partial support is better than nothing! If your workplace simply can’t agree cover all the expenses, propose having them cover only one component like the study materials only. Or ask for an hour off a day to study. There are lots of ideas scattered throughout this article, so get creative to figure out a set of benefits that works for both you & your workplace.

Hopefully, these tips left you feeling empowered to approach your employer to see what benefits are available to you. Consider asking if they will pay for our very affordable study materials to help you pass those exams! With our prices being significantly cheaper than most other options, it probably won’t be a difficult ask!

Why our study programs work

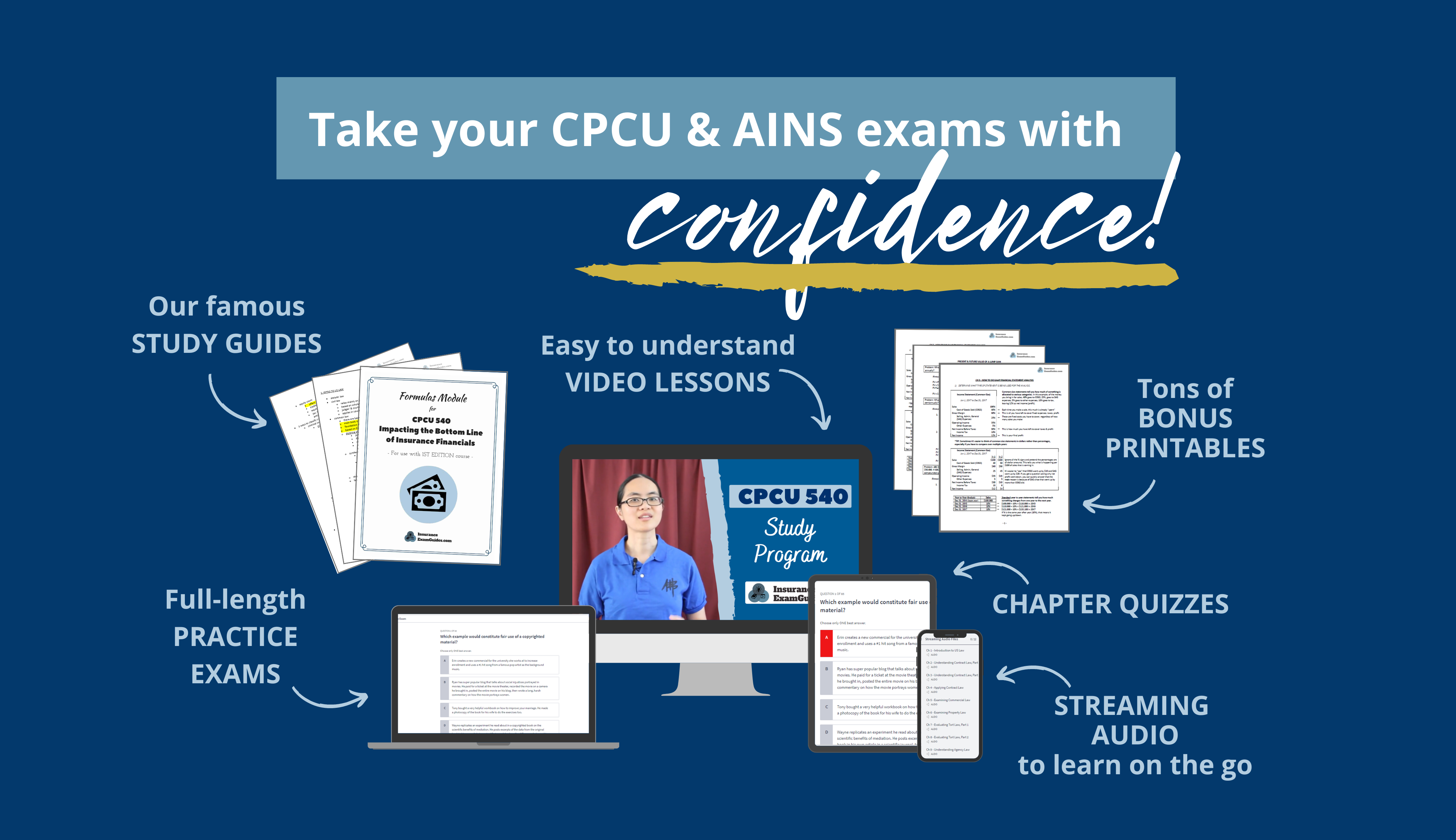

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Ace your AINS® & CPCU® exams with the help of our study materials!

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.