Earning your CPCU® designation can come with great benefits, but pursuing your CPCU is not necessarily the best investment for everyone. The reality is that the CPCU program is time-consuming and expensive, so it is important to think about what you want to get out of the designation and whether or not you are willing to invest the money & effort needed to get the most out of your designation.

In this post, we’ll talk about:

- Why do people pursue the CPCU designation?

- Can the CPCU designation really benefit you?

- When should you NOT pursue the CPCU designation?

Reasons for Pursuing the CPCU Designation

In general, there are four main reasons why people choose to pursue the CPCU designation:

- To learn more about insurance

- To take advantage of an employer-provided incentive

- To increase their networking opportunities

- To advance their career

Keep in mind that whether or not a designee will actually receive those benefits will vary depending on the factors discussed below.

Learning more about insurance

If your main goal is to expand your insurance knowledge, the CPCU program is an excellent way of achieving that goal. The CPCU courses cover a variety of relevant topics, and they will provide you with a good basic understanding of how insurance companies operate. You will also get a broad overview of how the most common types of property-casualty insurance policies work. However, if you are seeking in-depth knowledge of one specific element of insurance (claims, underwriting, etc.), there are other more specialized designations that would be better suited for that.

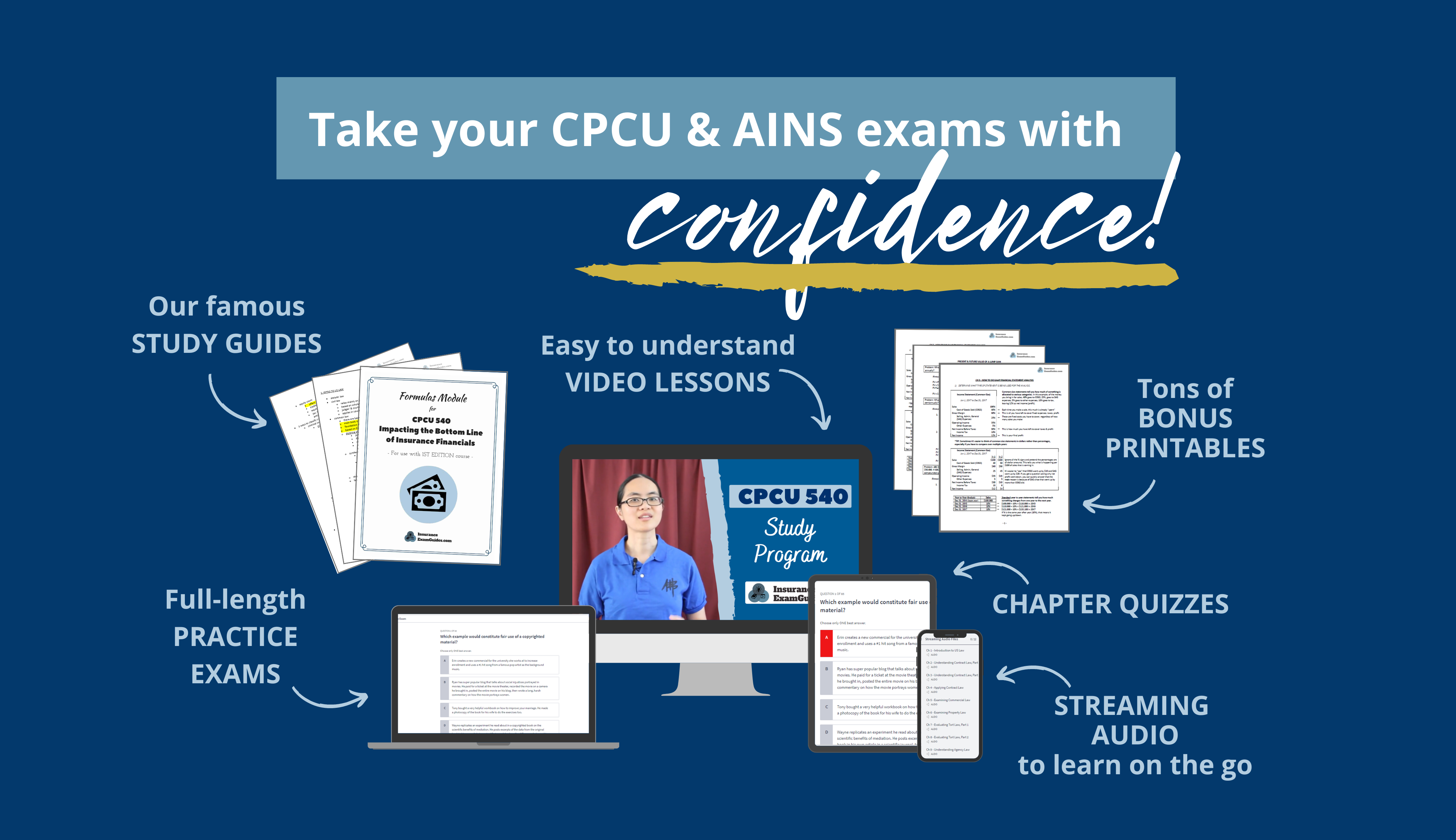

Ace your AINS® & CPCU® exams with the help of our study materials!

Taking Advantage of Employer-Provided Benefits

Some employers provide an incentive or other benefit to encourage their employees to pursue the CPCU designation. Some of the more common incentives include:

- Paying for the cost of the learning materials or exam fees

- Providing a cash bonus

- Covering some or all of the expenses related to the In2Risk Conference (the CPCU Society’s Annual Meeting, where new designees have their conferment ceremony)

If you decide to pursue the designation to take advantage of these benefits, it is important to understand what your employer’s terms and conditions are. Be sure to find out if there are situations where you might incur out of pocket costs (ex: many employers will not pay for you to retake an exam if you fail your first attempt).

Increased Networking Opportunities

Another reason that students might want to pursue the CPCU designation is to gain more networking opportunities. Students who are pursuing the designation and designees who have already earned it are eligible to join the CPCU Society, and many local CPCU Society chapters will host networking events or other helpful workshops. However, it is important to understand that having the designation by itself will not cause people to come knocking on your door. As with any networking opportunity, you still have to put in the effort to attend events, talk to people, and build relationships.

Again, having the CPCU designation can certainly spark a conversation with other insurance professionals who have an interest in the designation, and it gives you a chance to participate in CPCU Society events, but what you get out of those opportunities will ultimately depend on how much work you are willing to put in to develop those connections.

CLICK HERE TO GET STARTED

Advancing Your Career

This is the number one reason why students pursue the CPCU designation, but whether or not you will see a concrete benefit depends on several factors.

If your employer (or prospective employer) offers a clearly stated salary increase or has the CPCU designation listed as a minimum requirement (or desired qualification) for a certain job position, then earning the CPCU designation will clearly have a direct impact. However, that usually is not the case, so you need to be realistic about how the designation will help you professionally.

If there is a particular job position you are seeking, it is best to talk to the prospective employer and/or hiring manager to gauge how much weight they give to a candidate having the CPCU designation. Different companies and different managers will perceive the value of the designation very differently, and it never hurts to ask. You might discover that it would be more valuable to pursue another designation, or that there are other activities you can do besides pursuing a designation that will have more of an impact on the hiring decision.

Another way to get insight is to connect with other professionals who work in that particular area of insurance or at the company you have set your sights on, and inquire about how much the CPCU designation is valued there. In any case, the more information you have, the more accurately you can assess the real value of the designation with respect to achieving your specific goal.

If you do not have a specific job in mind, the professional benefit will be indirect, difficult to measure, and may or may not result in actual financial gain. Having the CPCU designation may give you a slight edge as a job candidate or increase customer confidence in you, but you can’t necessarily count on these things translating to an actual financial benefit that outweighs the cost of pursuing the designation. To be clear: there is nothing wrong with pursuing the designation for these indirect benefits–we simply want to provide potential students with a realistic sense of what they will and won’t get out of the designation to help them make the best decision for themselves.

Ace your AINS® & CPCU® exams with the help of our study materials!

Who Should NOT Pursue a CPCU Designation

Depending on what benefits you are seeking and your personal situation, completing the CPCU program is not necessarily the best career move for everyone. Here are some situations where you might be better off investing your time and money elsewhere:

You do not intend to stay in the insurance industry for very long

The CPCU designation is specific to the industries of insurance and risk management. It is unlikely to have much value outside of these realms, so if you don’t plan to make insurance and/or risk management a long-term career for yourself, you are probably be better off putting your money towards something else, such as a college degree that would be valued in a wider variety of industries.

You do not have the financial means to pursue the designation

Between the cost of study materials and testing fee, the CPCU program is pretty costly if you are not getting any financial assistance from your employer. Your financial well-being is very important, so we do not recommend pursuing the designation if you have to rely on any of the following to finance your studies:

- Taking on any form of debt (including credit card debt)

- Tapping into your retirement funds

- Dipping too deeply into your savings (to the point that you have less than 3-6 months worth of your monthly expenses)

TIP: Some employers will pay for their employees’ exam fees and study materials. Check with your company’s human resources department about this, or consider switching employers as this can save you thousands of dollars.

You are not sure you will be committed to studying and taking exams

The CPCU program is not easy. It requires you to go through numerous courses and take multiple tests that are very challenging, so you will need to have a certain level of focus and commitment. If you are not committed, pursuing the designation can get very expensive very quickly because you need to pay additional fees every time you retake an exam. Although there are many strategies you can use to help you stay focused and engaged, you need to be totally honest with yourself about whether or not you can and will commit to finishing the program.

You don’t know what you want out of the designation

Money is a finite resource, so you really should strive to make the best use of it and put it towards things that will clearly benefit you. Especially if you are paying for your studies on your own, pursuing the designation without knowing what you want out if it is not a good approach. Think about what you want out of the designation and what you are willing to do to get the maximum use out of it before investing so much time and money into the program.

CHOOSE YOUR COURSE

AINS 101

Increasing Your Insurance IQ

FREE study materials available!

(click LEARN MORE for details)

AINS 102

Understanding Personal Insurance

AINS 103

Exploring Commercial Insurance

CPCU 500

Becoming a Leader in

Risk Management & Insurance

CPCU 520

Meeting Challenges Across

Insurance Operations

CPCU 530

Applying Legal Concepts

to Insurance

CPCU 540

Contributing to

Insurer Financial Performance

CPCU 550

Maximizing Value with

Data and Technology

CPCU 551

Managing Commercial

Property Risk

Note: We will not be offering

a full online study program

for CPCU 551

![]()

CPCU 552

Managing Commercial

Liability Risk

Note: We will not be offering

a full online study program

for CPCU 552

CPCU 555

Advancing Personal

Insurance Products

Note: We will not be offering

a full online study program

for CPCU 555

CPCU 556

Building a Competitive Edge

in Personal Lines

Note: We will not be offering

a full online study program

for CPCU 556

Ethics 311

Ethical Decision Making

for Risk and Insurance

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.