CPCU® students often ask if it is necessary to get a financial calculator for the CPCU 540 exam.

You can absolutely pass the CPCU 540 exam without using a financial calculator, but some people ffeel more confident when given the option to use a financial calculator. In this post, we will explore the pros and cons of using a financial calculator, and we will also give you some tips to apply if you decide to use one for your exam.

Prefer to watch this post’s content instead of read?

Check out our YouTube video below and subscribe to our channel, or just keep scrolling if you’d rather read.

What is the financial calculator used for on the CPCU 540 exam?

The financial calculator is mainly used for chapter 2 of CPCU 540, which has to do with calculating the present and future values of money.

In a nutshell, the idea is that money you receive today is technically worth more in the future, because you have time between now and that future date to invest the money and earn interest on it. It also works the other way around: if you need a certain amount of money at a specific point of time in the future, you don’t need to deposit that full future amount now because you can invest a slightly lesser sum and let it grow to the desired amount by earning interest.

On the CPCU 540 exam, you will be given scenarios that require you to calculate the present or future value of the given dollar amount. There are two ways to calculate the correct answer:

- Using present/future value tables plus a basic calculator

- Using a financial calculator

The Institutes’ course does not show you how to use these tools, so you will have to turn to other resources such as our online course for CPCU 540 if you want to learn how how to do so.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

Should I get a financial calculator for the CPCU 540 exam?

There are several pros and cons to consider when it comes to deciding whether or not you should use a financial calculator versus just using the present/future value tables plus a basic calculator.

Ease of learning how to use them

For most people, the tables are much more intuitive and easy to pick up than the calculator. However, some students find that it is worth investing the time to learn how to use the calculator because once you master the button sequence, the calculator can do the math a little faster than a person doing manual calculations with the tables.

The button sequence for the financial calculator does vary from brand to brand, so it is important to find tutorials that are specific to your calculator brand. If you are not using one of the more popular calculator models, you will need to do your own research to learn what the button sequence would be for your particular calculator brand.

How IEG can help: We have you covered no matter which method you prefer! Our study materials for CPCU 540 include step-by-step instructions on how to use both the tables and the two most popular calculator brands (the Texas Instruments BA II Plus financial calculator and the HP 10bII financial calculator). NOTE: As of January 8, 2025, The Institutes has only confirmed that the tables & the Texas Instruments BA II Plus calculator will be permitted on the new proctored exams. We are waiting for The Institutes to clarify if other models such as the HP 10bII calculator will also be permitted.

Cost

You can easily find the present value and future value tables online and print them for free. We also include the tables as part of our CPCU 540 study materials.

In contrast, financial calculators cost about $30-40 brand new, but you can get them used for cheaper, or perhaps you know someone who can lend theirs to you for free. Another alternative is to download an app that mimics a financial calculator. The downside to using an app, though, is that you’ll probably have to figure out the proper button sequences on your own. There are plenty of YouTube videos for the two most popular financial calculator brands (the Texas Instruments BA II Plus financial calculator and the HP 10bII financial calculator), but not many for others.

Unless your profession is finance-related, you are highly unlikely to use the special functions of a financial calculator again. As such, some students prefer to avoid spending the money for a financial calculator or app, and use the tables instead.

Sense of Confidence

Some people feel better about going into the test with a financial calculator because it helps them calculate the answer faster and they are less likely to make simple arithmetic mistakes. On the other hand, some worry that they will mix up the button sequences and slow themselves down. Ultimately, it is better to go with whatever method you feel more confident in. This is a completely subjective factor that is dependent on you and you alone.

Which financial calculator should I get?

The Institutes has confirmed that students are permitted to use the Texas Instruments BA II Plus financial calculator for their exam. Another popular calculator is the HP 10bII financial calculator, but The Institutes has not yet confirmed if that too is permitted.

Tips for Using a Financial Calculator

If you decide to use a financial calculator for your exam, here are a few tips you should follow to ensure that everything goes as smoothly as possible:

#1: Practice, Practice, Practice

Technically, this tip applies to learning the present/future value tables as well, but we cannot emphasize enough the importance of practicing over and over until you feel completely comfortable using the calculator.

Work though as many practice problems as you can, and be sure to refresh your memory by practicing again the day before your exam.

How IEG can help: Our study materials for CPCU 540 will walk you through the exact button sequence to press for each type of present value & future value problem you may encounter. We also have tons of practice problems for you to test your mastery.

#2: Get in the Habit of Clearing Your Calculator Memory

One of the easiest ways to get the wrong answer for a problem is to forget to clear your calculator’s memory. If you don’t do that, the calculator might base its computation on variables from a prior problem you were working on. Make it a habit to clear your calculator’s memory every time before you even attempt a new problem.

#3: Double Check Your Batteries

If you do not have a solar-powered calculator, make sure you put fresh batteries in! You do not want to find out in the midst of your exam that your calculator died on you for a reason that was totally preventable.

CPCU 540 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 540: Contributing to Insurer Financial Performance (1st edition)

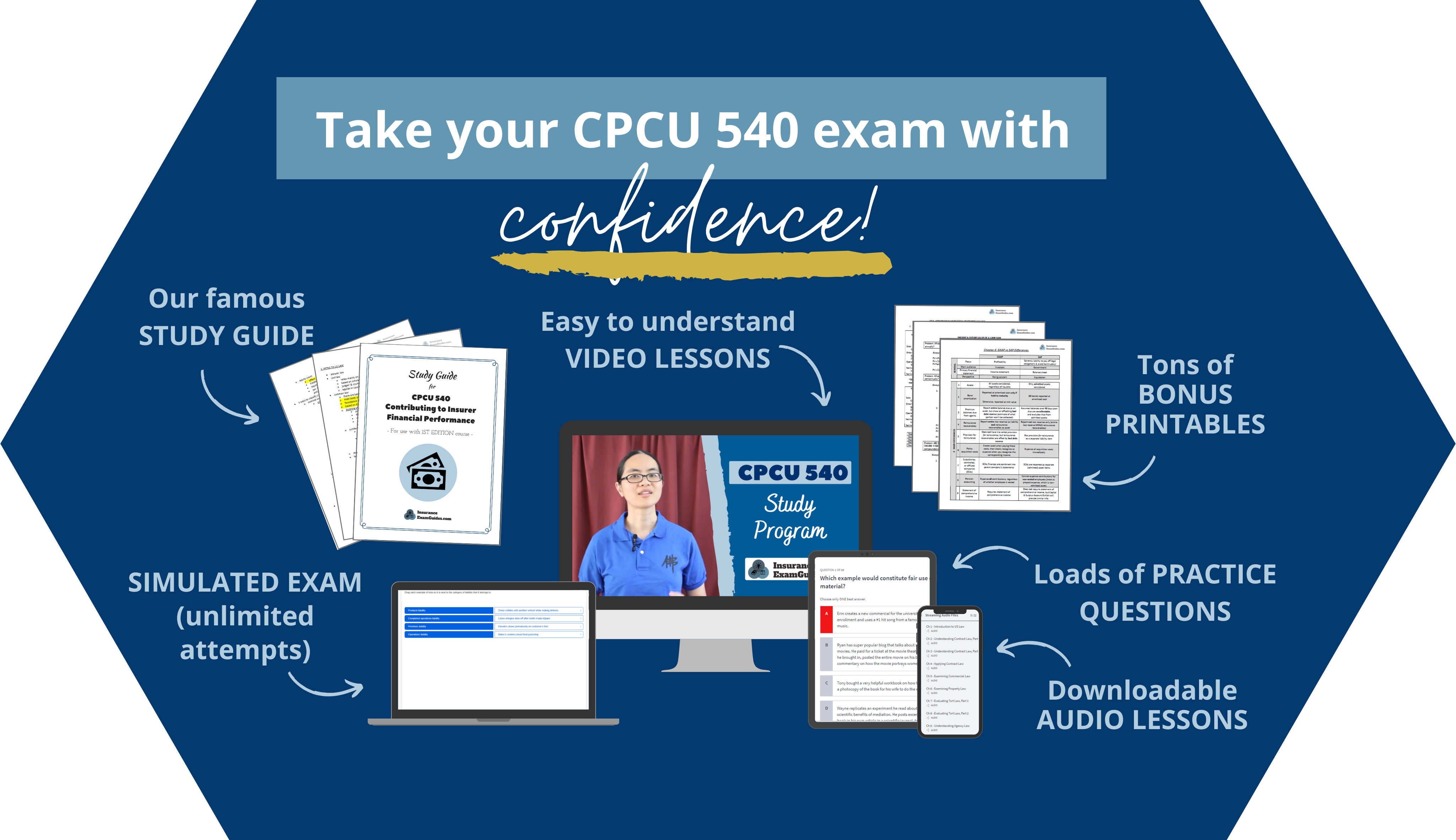

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.