In this part of our three-post CPCU® 540 Fundamentals series, we will delve into one of the most important insurance-related financial concept: policyholders surplus. Because this concept comes up so often through the entire course, you are much better off if you go into your studies already having a basic understanding of what the policyholders surplus is.

To improve your understanding of this discussion, we recommend that you read our other lesson about the accounting equation before diving into this one.

A quick refresher on equity

As discussed in our other post on the accounting equation, equity represents what portion of a company’s assets are not needed to satisfy the debts and liabilities the company has incurred. To get an idea of how strong a company is, you can’t just look at how much they have in money and assets. You have to offset that by the amount they owe in debts & other legal obligations (i.e., their liabilities) because at some point, the company will have to use some of their money to pay back those liabilities.

For example, if Joe borrowed $100,000 from the bank and put it into his savings account, it looks great when he shows everyone that he has $100,000 at his disposal. However, it is a lot less impressive when you find out that he also owes $100,000, which eventually he has to repay to the bank. In a sense, he doesn’t really have any money!

The same principle applies with businesses. You have to consider what is left over after you subtract out the a company’s liabilities from their assets. The remaining difference is their equity, which is the true measure of their financial standing.

Companies must carefully manage their liabilities so that they don’t appear to be so financially risky to anyone that is looking at their finances. Much of CPCU 540 is about explaining how each of the most common financial transactions that insurance companies engage in would affect that insurer’s liabilities versus their equity. It is helpful to remember this general rule of thumb: if you aren’t incurring a new debt or obligation to pay someone back, the transaction will impact the equity side.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

Difference between equity and policyholders’ surplus

One thing you will learn in CPCU 540 is that insurance companies are required by regulation to provide a special set of financial statements that are prepared using a special set of guidelines called statutory accounting principles (SAP). SAP uses a modified accounting equation, which is:

ADMITTED ASSETS = LIABILITIES + POLICYHOLDERS’ SURPLUS

SAP is focused on helping you evaluate whether an insurance company can pay off their liabilities quickly. This matters because unlike most other types of companies, an insurance company’s main liabilities are to their customers.

For most other types of companies, the majority of their liabilities are to creditors who took a risk in lending the company money. But an insurance company’s customers, their policyholders, are not expecting to take a risk when they buy insurance; they pay for the policy with the expectation that the insurer will pay for the insureds’ claims if those insureds have a covered loss.

When someone buys an insurance policy, the insurance companies has two new potential financial obligations to worry about: the potential claim payments they would have to make, and the potential refund that they have to give back to the customer if the customer decides cancels their policy before the term is up. Those two obligations make up the two most important liabilities that appear on an insurer’s balance sheet:

- Loss reserves, which represents how much the insurer predicts they will end up having to pay out for their policyholders’ claims), and

- Unearned premium, which is the portion of premium they have not earned yet and would need to refund to a customer if that customer decides to cancel their policy before the term is up.

Owing your customers money has far more weight than owing your creditors, so the government monitors insurance companies very closely to ensure that ensurers can follow through to provide the coverage they promised their customers.

In theory, the standard accounting equation (ASSETS = LIABILITIES + EQUITY) tells us that as long as we have more assets than liabilities, we should be able to pay off all of our obligations. That’s because we can sell off all our assets, use some of the money to pay off all the liabilities, and then still have something leftover (the equity part). But in reality, not all assets are equally helpful if you needed to liquidate your company immediately and pay off all your obligations. Some assets are difficult to sell or convert to cash quickly. For example, if you had a building or a patent, those are technically classified as assets, but it may take a long time to find a seller. For this reason, SAP only lets insurers count assets that meet a minimum level of liquidity, meaning it is fairly easy to determine that asset’s value and then sell it off quickly. Under SAP, these types of more-liquid assets are referred to as admitted assets.

If we go back to the SAP accounting equation (ADMITTED ASSETS = LIABILITIES + POLICYHOLDERS’ SURPLUS), we can see that policyholders’ surplus (often shortened to PH surplus or just surplus) refers to how much equity we would have left if we immediately sold off our admitted assets and used those funds to satisfy all of our outstanding liabilities. Compared to the equity part of the traditional accounting equation, policyholders’ surplus is a much more conservative number, because we are only counting our more liquid assets rather than considering all assets when evaluating if we have enough to pay all of our obligations on a moment’s notice.

The conclusions we drew during our lesson on the accounting equation are still applicable to policyholders’ surplus:

- Any time we have a change in total admitted assets, there must be an equal change to the liabilities/PH surplus side of the SAP accounting equation.

- It is preferable to increase policyholders’ surplus instead of liabilities, because there is no obligation to pay PH surplus to anyone.

Why is policyholders’ surplus so important?

There are two major reasons why insurance companies & regulators pay so much attention to policyholders’ surplus:

#1: It is a measure of solvency

Solvency refers to the ability to pay your bills and obligations as they come due. The government heavily regulates the insurance industry, mainly to ensure that insurance companies aren’t so careless or reckless in their business operations that they end up going bankrupt. This is necessary because insurance companies sell something really unique: a promise, rather than a normal good or service. Insurance companies earn their money by promising to pay claims for their customers if something happens.

Customers rely on those promises to keep from suffering devastating setbacks in the event of a loss or catastrophe occurring. Having that safety net is very important to ensure our society & economy function smoothly, with minimal interruption. If insurance isn’t available to help people compensate for their losses, people & businesses would constantly be in danger of having their money wiped out every time they had the bad luck, like if had a car accident or fire. If this fear was always present, people & companies would be too scared to own things and do things.

So, the government needs to keep insurance companies in check and make sure the insurers are financially strong enough to stay in business and honor those promises to pay. One key indicator of solvency is an insurance company’s policyholders’ surplus, which basically represents how much of their assets aren’t already tied up to pay for their pending liabilities.

To better illustrate, using the accounting equation, let’s go back to Joe’s example where he borrowed $100,000 from the bank. At that point, his accounting equation will look like so:

JOE: $100,000 (cash) = LIABILITIES $100,000 (loan) + EQUITY $0

Although he has a lot of cash, it’s not his outright. Now, if his $1000 rent came due and he paid it out of the cash he had, his assets would decrease by $1000, and there would have to be an offset to the liabilities/equity side for the accounting equation to balance. Now, him paying his rent obviously doesn’t reduce the amount he still owes the bank, so what would happen?

JOE: $99,000 (cash) = LIABILITIES $100,000 (loan) + EQUITY (-$1000)

As you can see, when you overexert yourself financially, it will clearly reflect in your equity. It is never a good idea to have all your money come from borrowed sources (liabilities) for too much longer than when you initially start a business. You want to start earning profit as soon as possibility to build up your equity, because eventually you need to give back the borrowed money. If Joe doesn’t find a way to earn more cash again without borrowing again, he will be in a lot of trouble when it comes time to pay back his bank loan because he simply doesn’t have the assets to do so.

The government will do the same thing with insurance companies, monitoring their policyholders surplus amounts and comparing them to their assets and liabilities to see if it looks like the equity is dipping dangerously low. The government will start to take action well before an insurance company’s equity gets close to $0, because they don’t want insurance companies to get that close to insolvency (when you owe more than you actually have).

#2: Capacity allowed is based on policyholders’ surplus

When insurance companies sell policies, they know that some of their premiums are going to be spent on paying claims. Insurance companies have actuaries that do complex statistical analysis to predict what is going be paid out for claims, and then they set that amount of money aside in anticipating of using it to pay for claims. However, an actuary’s prediction is just that–it is only a prediction. There is always the possibility that they will be wrong and have underestimated the claim payouts, meaning the insurance company ends up paying more in claims than they thought they would have to. When the insurance company is wrong about their projected loss payments, the shortfall has to come from their policyholders’ surplus.

Let’s see how this affects the accounting equation and start with a hypothetical insurance company’s account balances on Jan 1.

ASSETS $500,000 (cash) = LIABILITIES $400,000 (expected claims payouts) + EQUITY $100,000

At this point, we are saying that this insurance company has a lot of cash, but we predict that they are going to have to pay $400,000 in claims. To avoid spending the money on other things, the insurance company assumes it is money that is ultimately owed back to their policyholders as claim payouts, so they will record it as a liability in their financial statements.

But what happens if they have actually paid $425,000 in claims by the end of the year? First, they will have to reduce their cash by the same amount because it’s was spent on those claims. To keep the accounting equation balance, we also need to reduce the other side of the equation by $425,000. We can eliminate the $400,000 liability for expected claims payouts because they paid their claims and have satisfied that legal obligation to their policyholders. But there is still a difference of $25,000 that has to come from somewhere. When they paid off that extra $25,000, they weren’t incurring new debt, so the offset wouldn’t be a liability. As such, they would have to record a reduction in the equity for the equation to work out. Their new balance sheet would be:

ASSETS $75,000 (cash) = LIABILITIES $0 (expected claims payouts) + EQUITY $75,000

Like we’ve mentioned before, equity represents the portion of an insurance company’s assets that aren’t earmarked for paying off a known debt or obligation that is coming later down the line. In that way, then, you can think of equity as an insurance company’s emergency savings; any time the insurer has more expenses than they thought, they’ll have to tap into this emergency savings to come up with the difference if they aren’t borrowing the money from somewhere.

Now, the government knows that the insurance company could always be wrong in their prediction of how much in claims the insurer thinks they’ll have to pay, so the government want to see an ample amount of policyholders’ surplus available as a safety cushion for that possibility. More specifically, they want to see at least one-third of the amount of premiums you write available as policyholders’ surplus. In other words, for every $1 of equity you have, you are only allowed to underwrite $3 of premium. So, if you have $100,000 in policyholders’ surplus, you are allowed to sell up to $300,000 worth in policy premiums. If you have $500,000 in policyholders’ surplus, you can write up to $1.5 million worth in policy premiums.

This amount of insurance that you are allowed to sell is called your capacity. The more policyholders surplus you have, the more insurance you are allowed to sell and the more opportunity you have to expand your business. As such, it is always advantageous to maximize your policyholders’ surplus as that will maximize how much potential business that you are allowed to do.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

Surplus relief

There is one more important concept addressed in CPCU 540 that is very closely related to policyholders surplus.

Surplus relief involves alleviating the financial pressure that might fall on an insurance company’s policyholders surplus. To understand this concept, it helps to use an analogy from your personal life:

Let’s say that all your bills just happen to be due on the first of each month – rent, car payment, utilities, cell phone, etc. If you don’t get paid until the 5th of the month, you’ll need to tap into your savings at the beginning of each month to pay the bills first. Then, as you get paid, only then can you replenish your savings (and hopefully add more to it than you had before). This means that there is a lot of pressure on your savings at the beginning of the month, especially if you don’t have a lot.

Insurance companies face a similar problem: By regulation, they are required to recognize expenses immediately on their financial reports, but they also required to spread out the revenue they earn over time. Let’s say a hypothetical insurance company has an initial accounting equation as follows:

#1 (starting equation): ASSETS $50,000 cash = LIABILITIES $20,000 + EQUITY $30,000

As they incur expenses to issue a new policy (such as running credit checks on the insured, paying the selling agent’s commission, paying a risk management consultant to do an initial inspection of the insured’s premises, etc.), there is an immediate reduction in assets for all the cash they are paying to cover these costs. Since the insurer usually isn’t incurring a new debt to cover these expenses and just uses cash, the reduction in cash assets has to be balanced on the other side of the accounting equation by a reduction in equity:

#2 (after $1000 in initial expenses): ASSETS $49,000 (cash) = LIABILITIES $20,000 + EQUITY $29,000

Now, most types of companies will also immediately add any income they collected from the customer into their asset side, which results in a corresponding increase in the equity bucket too. As such, the expenses they incurred that are associated with a sale don’t hurt their equity because there was positive cash flow occurring at the same time.

Insurance companies, however, are different. Even though they receive money upfront for the premium payment that a customer makes, by regulation they aren’t allowed to recognize it as business income right away because they haven’t technically earned that money yet. If the customer cancels their policy part way through the policy term, the insurance company will have to give that money right back as a refund for the unearned portion of the policy. So, in the beginning, the money they receive is reported as a liability called unearned premium.

For example, if this insurance company sold a policy for $2,000, they would record the increase to their cash, but must also offset that by an increase in liability for the unearned premium that could potentially get refunded:

#3 (immediately after receiving $2,000 in premium payment): ASSETS $51,000 (cash) = LIABILITIES $22,000 + EQUITY $29,000

As the customer’s policy term goes by, the insurer is deemed to have earned the money and the customer is no longer entitled to a refund for the portion of time that has passed. As such, a portion of the unearned premium liability will get moved over to the equity part of the equation because the insurer no longer has the obligation to pay back the premium to the customer. By the end of the policy period, the $2,000 in premium is fully earned and the equation would look like this:

#4 (after $2,000 policy premium has been fully earned): ASSETS $51,000 (cash) = LIABILITIES $20,000 + EQUITY $31,000

At the very start of the policy, though, if we compare #1 (from before the sale of the policy) to #3 (just after the sale of the policy, but still at the start of the policy period), we can see that even though our cash assets went up, our equity took a hit from the sale. And, if you multiply this same effect by the thousands of policies sold, you realize that the equity can keep going down very quickly because of all the expenses that get incurred at the beginning of all the policy periods. In this way, this initial imbalance puts pressure on the policyholders’ surplus, kind of like how to your savings account did in the first example we talked about (when all your bills were due before you got paid)

Surplus relief, then, refers to any time you receive funds that help “relieve” some of the financial pressure caused by this imbalance. This usually happens if the insurance carrier can get some sort of money upfront at the same time they are recording their initial expenses. The most common example of surplus relief is when insurers getting a ceding commission from their reinsurance company.

A quick crash course on reinsurance: reinsurance is a type of insurance that insurers can buy, which then allows them to split the cost of the claims they owe with the reinsurer. For example, a primary insurance company might enter into a reinsurance agreement where the reinsurer agrees to cover 50% of any claims presented by the primary insurer’s underlying customers. Part of that deal requires the primary insurer to split the premiums they collect from the underlying insured with the reinsurer too. But, since the primary insurance company is the one dealing directly with the customer, they are also the one spending all the money to acquire the customer and service that customer’s policy (ex: marketing, office overhead, background check expenses, etc.). It would be fair for the primary insurance company to bear all of the expenses when they having to share the income with the reinsurer. As such, reinsurers will often pay a sum of money to the primary insurance company to help cover some of the primary insurer’s costs that are associated with earning premium. That sum of money is called a ceding commission.

Going back to the personal example of you paying your rent, this is just like if you were responsible for paying the rent to your landlord but your roommate gave you their share at the beginning of the month. Even though you have to pay out a big sum right away (the rent), there isn’t as much pressure on your savings if your roommate reimburses you quickly. Likewise, if an insurance company has a bunch of expenses to record upfront, this ceding commission that they get paid makes the hit to their policyholders surplus’ not as bad, providing much-desired surplus relief.

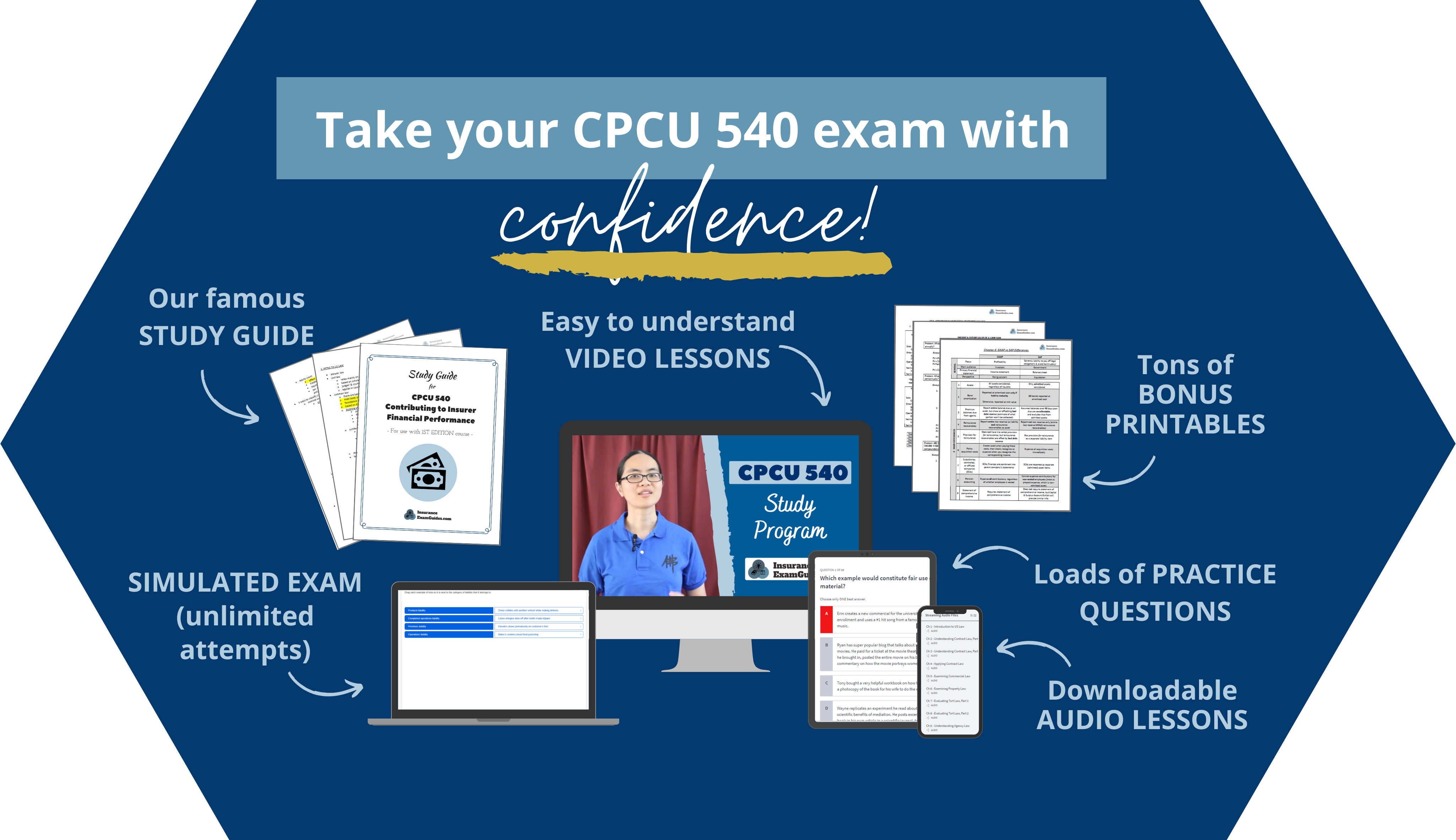

CPCU 540 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 540: Contributing to Insurer Financial Performance (1st edition)

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.