The actuarial chapter of CPCU 520 introduces three different rate-making methods that insurance companies use to decide what rates to charge for their insurance products. The goal of this tip to explain the methods in a more simplified manner, so that they are easier for you to understand and memorize.

#1: Pure premium method

The idea behind this rate-making method is to break down the rate into various components, calculate each of them individually, then combining them to get the final rate to charge. The method has 4 very technical-sounding steps:

- Calculate the pure premium

- Estimate the expenses per exposure unit

- Determine the profit & contingency factor

- Calculate the rate per exposure unit.

It’s a lot easier to remember them if you think of them in terms of what the purpose of each step is:

1. Figure out how much you need to cover your claims

This step is asking: “How much do you need to charge per exposure unit to ensure you have enough to cover claims?” If you take the total losses you incurred and divide that by the number of exposure units you have, the result tells you how much you had to have charged per exposure unit to generate enough premium to at least cover those losses. This per-unit amount is called the pure premium amount.

2. Figure out how much you need to cover other operating expenses

The same idea applies in step two, where you divide the total expenses you had by the number of exposure units you insured. This gets you the amount you had to charge per exposure unit to cover your general expenses. This per-unit amount is referred to as the expense provision.

3. Figure out how much profit margin you want to make

The problem should always provide you a percentage to plug into the formula that accounts for how much profit margin & additional extra emergency funds you want. This percentage is usually referred to as the loading percentage.

4. Put it all together to figure out how much to charge per exposure unit

pure prem + expenses per exposure unit

1 – (profit & contingencies %)

The book does mention another variation of the formula to use in the event that you are given expense information separated into two parts: fixed expenses versus variable expenses. Fortunately for this variation, you’re usually given all of the components so all you need to do is remember the formula & plug in the appropriate numbers:

pure prem + fixed expenses per exposure unit

1 – (variable expense %) – (profit & contingencies %)

Get Your CPCU 520 Study Materials NOW!

Looking for our printables-only package? Click here.

#2: Loss ratio method

This rate-making method is based on the concept of looking at whether you did better or worse than you thought you would perform, then adjusting your rate accordingly. If you are doing better than expected, you can lower your rate to be more competitive. If you are doing worse than you had initially predicted you would, you’ll need to increase your rates to make up for the losses so far.

1. Calculate or confirm actual loss ratio

This formula is the exact same one that you learned in chapter 1 – the loss ratio. Plug in the data into the loss ratio formula to see how many cents per dollar you are actually spending on claims.

incurred losses + loss adjustment expenses (LAE)

earned premiums

2: Calculate expected loss ratio

You should always be provided a expense provision percentage. Just convert it to a decimal and subtract that from 1 to get the expected loss ratio.

3. Calculate rate change

Plug in the results into the rate change formula to determine if you should increase or decrease rates. Remember, if your actual loss ratio is higher than your expected loss ratio, that means you are spending MORE THAN you thought you would have to on claims and will need to increase your rates to try make up for the additional costs you’ve been incurring.

On the other hand, if your actual loss ratio is lower than the expected loss ratio, you are spending LESS THAN you had planned to. As a result, your answer should be a NEGATIVE number and you will be DECREASING your rates by that percentage. For example, if the current rate is $200 and the formula gives you -5%, the new rate to charge is $200 minus 5% ($10), or $190.

actual loss ratio – expected loss ratio

expected loss ratio

#3: Judgment method

This is the easiest rate-making method to remember because there is no set formulas! Essentially, the rate is set based on the actuary using his or her experience & judgment. It is typically used when the exposure being evaluate is very unique or complex, making it hard to come up with a particular formula that will always fit all insureds.

CPCU 520 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 520: Meeting Challenges Across Insurance Operations (1st edition)

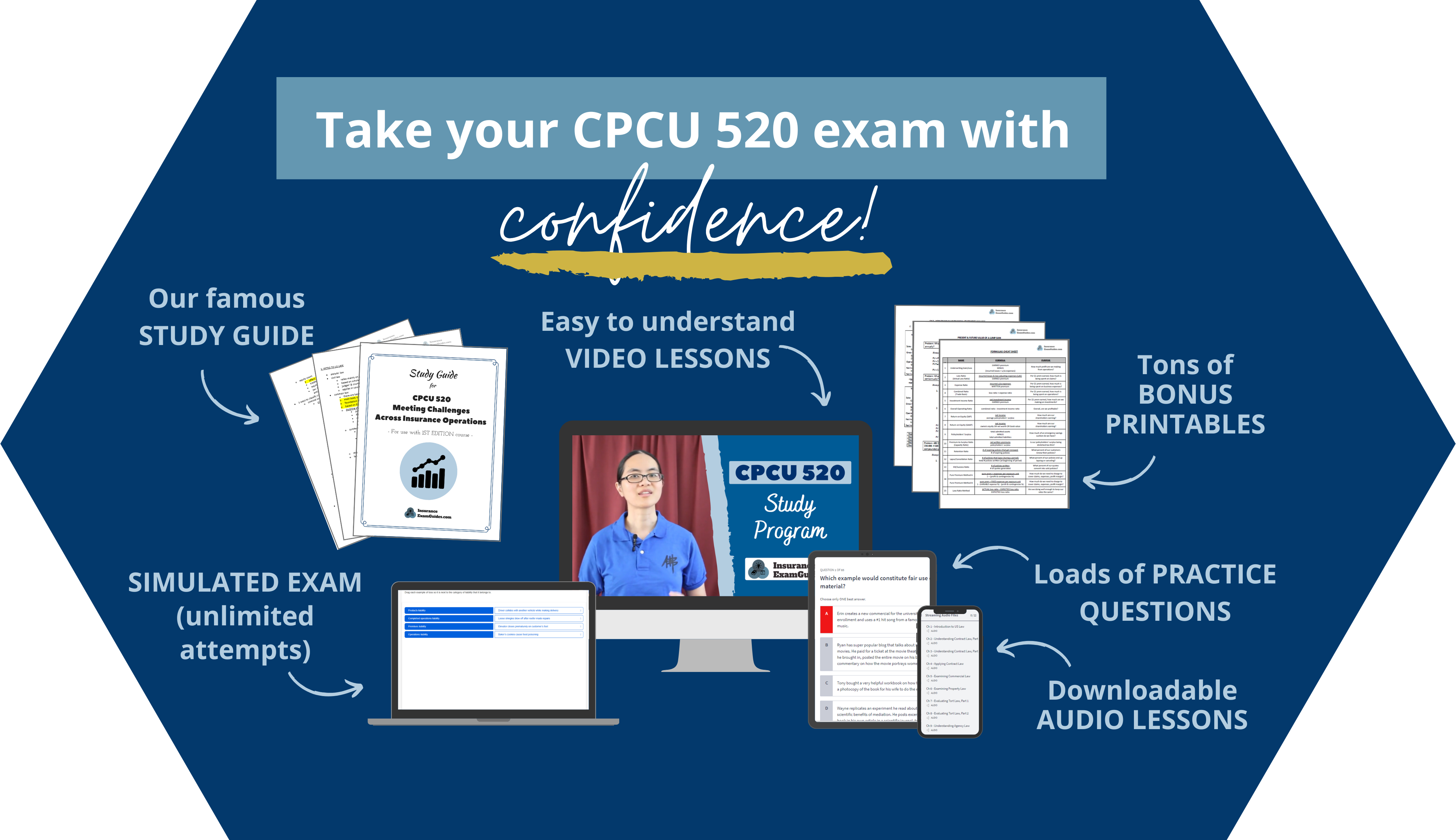

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get Your CPCU 520 Study Materials NOW!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.