Most people don’t consider the importance of having scratch paper handy when they take their exam, but there are several smart uses for it that can make it surprisingly handy. In this post, we round up some of the best uses we’ve come across so far for using this overlooked tool.

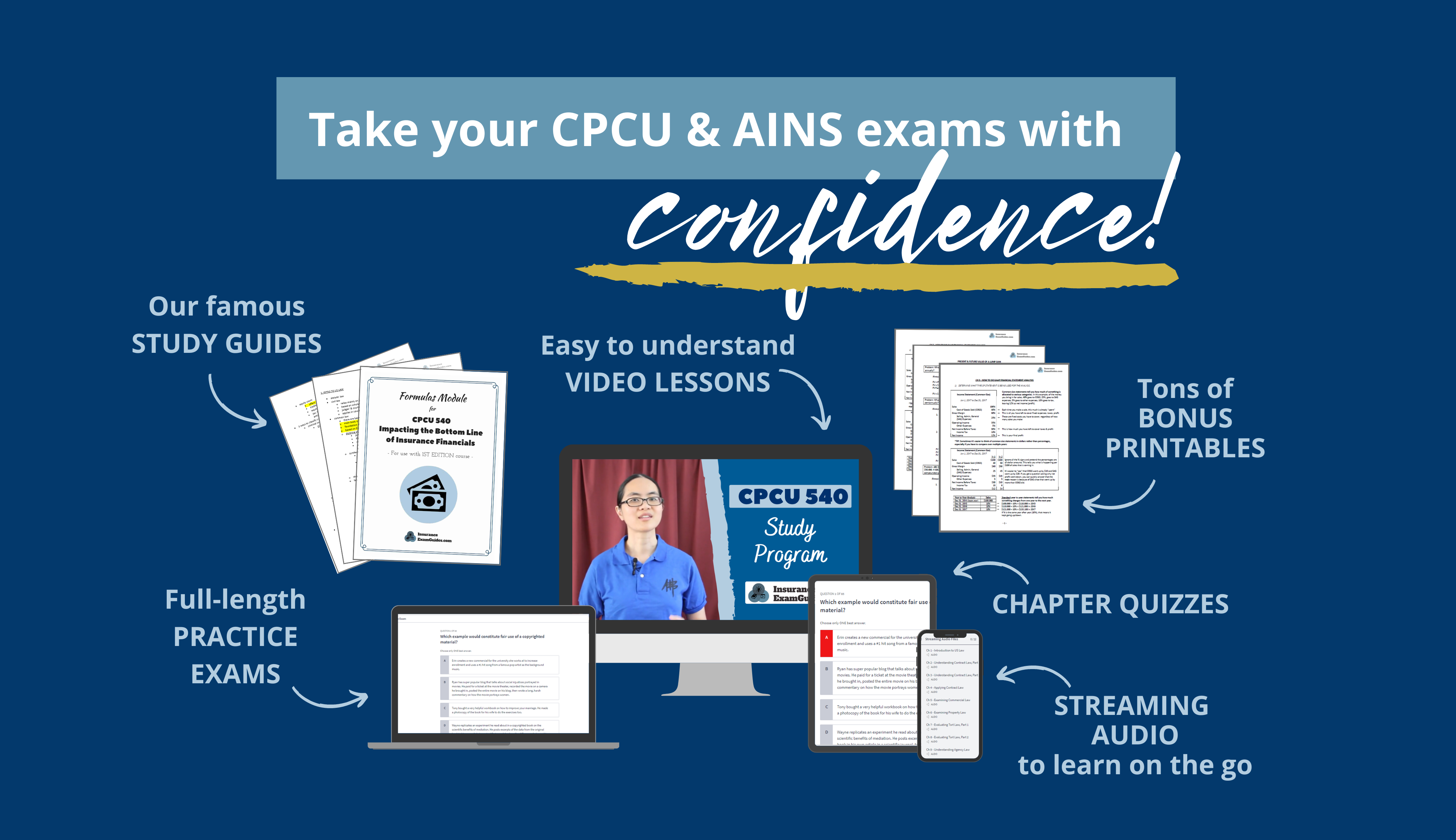

Ace your AINS® & CPCU® exams with the help of our study materials!

#1: Create a cheat sheet

As recommended in one of our other posts, How to Memorize CPCU Formulas, one smart use for your scratch paper is to jot down all the formulas you’ve memorized as soon as you start your exam. Writing down all the formulas then gives you a chance to dump all that baggage from your head while it is still as fresh as possible. After that, you can give the test your undivided attention, without having to worry about continually remember the formulas in the back of your mind. You now have a handy cheat sheet you can turn to any time you get a question about the formulas, whether they are conceptual or computational questions.

But you don’t have to limit yourself to just formulas. The truth is, you can use this same strategy with pretty much any content you find particularly tricky. Just study it all the way up until you start your exam, then jot down everything you can as soon as you begin. Another thing you can write down right away is any acronyms and spell them out what their letters stand for, all before you start going through the questions. Anything is fair game!

#2: Breaking down longer problems

Some of the questions you will encounter on your exam can be incredibly long. You can get bombarded with so many details that your head starts spinning halfway through reading the problem. One strategy, which we covered in our post How to Handle Long Test Questions on the CPCU Exam, is to break down the problem details into a bulleted list. Here is the same example we used in that post, to show you a side-by-side comparison:

Benjamin has his home insured with Westfork Mutual under an HO-3 policy for $100,000. He is the named insured on the policy. There are three other residents of the home: Maria, Benjamin’s mother; Daniel, his nephew; and Cian, a family friend. An accidental fire causes damage to the home and to personal property of all four occupants. Benjamin reports the loss to Westfork and Fatima, a claim representative, is assigned the claim. Which one of the following will most likely be Fatima’s principal concern when analyzing coverage for the loss?

You could recap the problem in a bulleted form, like so:

- HO3 pol for $100k

- Benjamin = named insured

- 3 other residents

- 1) Maria (mom)

- 2) Daniel (nephew)

- 3) Cain (family friend)

- Fire = cause of loss

- Damage to home & personal property of all 4 people

See how much easier it is to understand the information or refer back to the key details when it is listed like this instead? Any time you feel overwhelmed with the level of details in a particular problem, you can use your scratch paper to help sort things out.

CLICK HERE TO GET STARTED

#3: Making notes about questions to revisit

The test system allows you to flag questions that you want to come back to, but sometimes it helps to take down more specific notes.

For example, let’s say question #5 asks you the definition of a particular term. Later, question #63 happens to describe that term in the test question itself. You can mark down on your scratch paper that #63 has the definition of the word so that when you go back through your flagged questions and get to #5, you’ll know that a clue to answer is in #63.

Or, let’s say you are working a complex problem and can’t narrow it down to one correct answer choice, but it is eating up too much of your time so you guess an answer for now and flag it to come back later. In addition to flagging that question to revisit, you can take notes on your scratch paper as to which answer choices you were able to eliminate and why. That way, when you come back to it later, you don’t have to waste time reworking the problem from scratch and focus only on the answer choices that could potentially be right.

#4: Showing your work for math problems, no matter how simple they are

Some courses are formula-heavy, like CPCU 520 and CPCU 540. Others don’t really have formulas for you to memorize, but they can still ask you questions that involve basic math, like how much is covered under a particular scenario.

No matter how simple the math is, write out the numbers and exact functions you use (+, -, x, ÷). Compare the numbers you wrote down to make sure they match the numbers given in the problem; you don’t want to get a problem wrong simply because you added $500 when the problem said $50.

After you arrive at your answer, re-enter the calculation into your calculator a second time to make sure you didn’t mis-key anything.

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.