In this part of our three-post CPCU® 540 Fundamentals series, we will teach you about stocks and bonds. The Institutes’ doesn’t go into these types of investments too much until Chapter 8, but they come up right from the start of the course and reappear over and over again throughout the entire course. You are much better off if you go into your studies already having a basic understanding of the main differences between stocks and bonds.

Both are key ways for any business, including insurance companies, to raise money to run their operations. Also, insurance companies earn a lot of their income from investments, which will include stocks and bonds. As such, there is much to know about stocks and bonds, from both the perspective of being a buyer and also from being a seller.

We’ll begin by defining what stocks and bonds are, then show how each of them can affect a company’s accounting equation very differently. Let’s start with the easier of the two investment types to understand: bonds.

Prefer to watch this post’s content instead of read?

Check out our YouTube video below and subscribe to our channel, or just keep scrolling if you’d rather read.

What are Bonds?

All businesses need cash to operate, period. You need money to buy supplies, pay your employees, get inventory, and so forth. These operating funds that you need are often referred to as capital.

Whenever a business needs capital, one way they can get it is by borrowing. If you do so, your accounting equation will show an increase in assets (for the cash you receive) and a corresponding increase in liabilities (because you’ve now incurred a debt that you eventually have it pay back). Taking a loan from a bank is one way to borrow money, but another common way for businesses to borrow money is to issue bonds.

Bonds are essentially a way for you to borrow money from private investors, without having to go through a financial institution. When you issue a bond, the buyer (a private investor) buys it from you for a specified amount of money, which is referred to as the principal. In exchange, you enter into a legally-binding promise to pay them back the principal amount by a certain date plus interest, to compensate that investor for temporarily lending you the principal money. A standard bond will always have a deadline for repayment, and a specified interest rate (or a specified method for calculating the interest rate). In CPCU 540, you will also learn about the many bond variations that exist (such as zero-coupon bonds), but in general, you can assume that the bonds being discussed will have these three characteristics (a principal amount, deadline for repayment, and interest rate) unless stated otherwise.

The obligations you have for repaying a bond are legally-binding, meaning if you do not follow the terms, you can get sued and the investor who lent you the money is entitled to take your assets to get their money back. In addition, most bonds have to be repaid regardless of how your company is performing financially. In this way, bonds puts pressure on you to perform well because you always need to earn enough profit to keep up with any interest payments you owe during the life of the bond, and then ultimately have enough money at the end of the bond’s term to repay the principal amount. Ideally, of course, you’d want to earn so much profit that you can pay back the principal, plus pay the interest owed on the bond, and then still have some remaining profit for yourself to continue the business afterwards without having to borrow more money again.

It is helpful to remember that pretty much any time the textbook refers to “issuing debt” or “raising capital via debt,”they are essentially talking about raising money by selling bonds. Every time you do that, you are increasing your liabilities, and you need to plan for the periodic interest payments you’ll owe plus the final principal repayment.

Now, insurance companies don’t just deal with bonds in the context of issuing them to raise money. They also will invest in bonds, meaning they buy bonds and expect to earn interest on them. To a bond investor, the desirable traits about bonds are that all the expectations are very clear: you know exactly when you’ll get your interest & principal payments, and how much interest you will earn.

Essentially, the main things you want to remember about bonds are that:

- They represent borrowed money (i.e., they are a financial liability)

- They have a specific deadline for repayment

- There is specified interest rate (or specified method for calculating the interest rate) that the bond issuer is paying to the investor to compensate the latter for “lending” their money

- The bond-issuer must repay the investor according to the bond terms, regardless of how their business is performing

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

What are Stocks?

Another way for companies to raise money for themselves is to sell stocks, but these come with a lot more uncertainty when compared with bonds.

When you sell stock to raise capital, the buyers will give you money in exchange for one or more shares of your business and become co-owners of your business. The expectation is that when you eventually become profitable enough, you will occasionally share those profits with your shareholders. Those profit-sharing payments are referred to as dividends. Unlike with a bond, though, there is nothing that spells out exactly how much or how often you will have to pay shareholder. In other words, you are asking the investor to simply trust that you will share your earnings with them when you feel like you have enough profit to spare.

For the company that is selling the stock to raise capital, this flexibility can be very attractive. Growing businesses prefer to reinvest any profits they make back into the business, so they can expand and keep increasing their potential to make more and more profit. Since a stock issuer has no set obligation to pay their shareholders certain amounts at certain times, the stock issuer is free to use capital in any way that benefits the business. Or, if the stock issuer happens to have a bad year financially, they aren’t faced with the pressure of finding some way to make interest payments or principal repayments (a problem that you would had if you had issued a bond instead).

Furthermore, any money you raise by selling stocks shows up as equity in your accounting equation, as opposed to showing up as a liability. As we’ve mentioned before in this series, equity always looks better on your financial records than liabilities do. Again, bonds are recorded as a liability because you are legally required to repay that debt, but there is no such obligation with stocks, so stocks are counted as equity.

Now even though there is no specified deadline for repayment, stockholders still definitely expect to make some money eventually. It’s just that stockholders are going for a different strategy than bondholders. With stocks, the investor is looking for long-term gain and hopes that the business will eventually grow to a point that it makes way more money than it makes now. If a business successfully grows, so does their potential to pay bigger dividends, which makes the stock itself more valuable. For example, a stock that tends to pay $20 a year in dividends might be worth $200, but a stock that tends to pay only $5 a year in dividends might only be worth $75. If an investor is able to buy a stock while it is worth only $75 and wait until it grows to a point that it pays more dividends becomes worth $200, the investor can sell their stock at that point and pocket $125 in profit.

So, shareholders stand to make money both from dividends and also from the increase in the value of their stock if the investor is later able to sell the stock for more than what they bought it for. That gain in value is called capital gain, and sometimes that gain can be extremely significant. The potential you can earn from a stock is usually a lot greater than from a bond, but because there are no set deadlines for payments, they also come with a lot more risk– if the business fails, the shareholder can lose all the money they invested.

Any time the book mentions “issuing equity” or “raising capital via equity,” they are referring to raising money by issuing stocks. Again, remember that there is no definitive obligation of repayment, it applies to the equity portion of your accounting equation, not the liabilities portion.

As with bonds, insurance companies don’t just use stocks to raise capital; they also invest in other companies’ stocks in hopes of earning investment income. As explained above, there is more risk that comes with investing in stocks, but there are also benefits. While it is true that bonds are a lot more clear about much interest you will earn and when you will earn it, there isn’t much potential to earn more than what is already stated in the bond’s terms. With stocks, however, since there is no set interest rate or repayment schedule, there is no limit to how much you can earn.

On top of that, with bonds, once the principal you invested is paid back to you, you stop earning money. But with stocks, you could theoretically keep getting dividend payments for as long as you own the stock. And if a company you invested in does really well financially, the value of their stock will tend to go up over the long run, so you could also earn a sizable return if you ever decide to sell a well-performing stock. That type of opportunity for significant capital gain doesn’t exist with bonds.

In this course, you will learn that there are numerous variations of stock types, but the main points to associate with standard stocks are that:

- They represent invested money that has no specified obligation of repayment (i.e., equity)

- Investors are not entitled to a predetermined interest rate

- Investors make money from both dividend payments and capital gains

- Stocks are much riskier than bonds, but provide greater earning potential

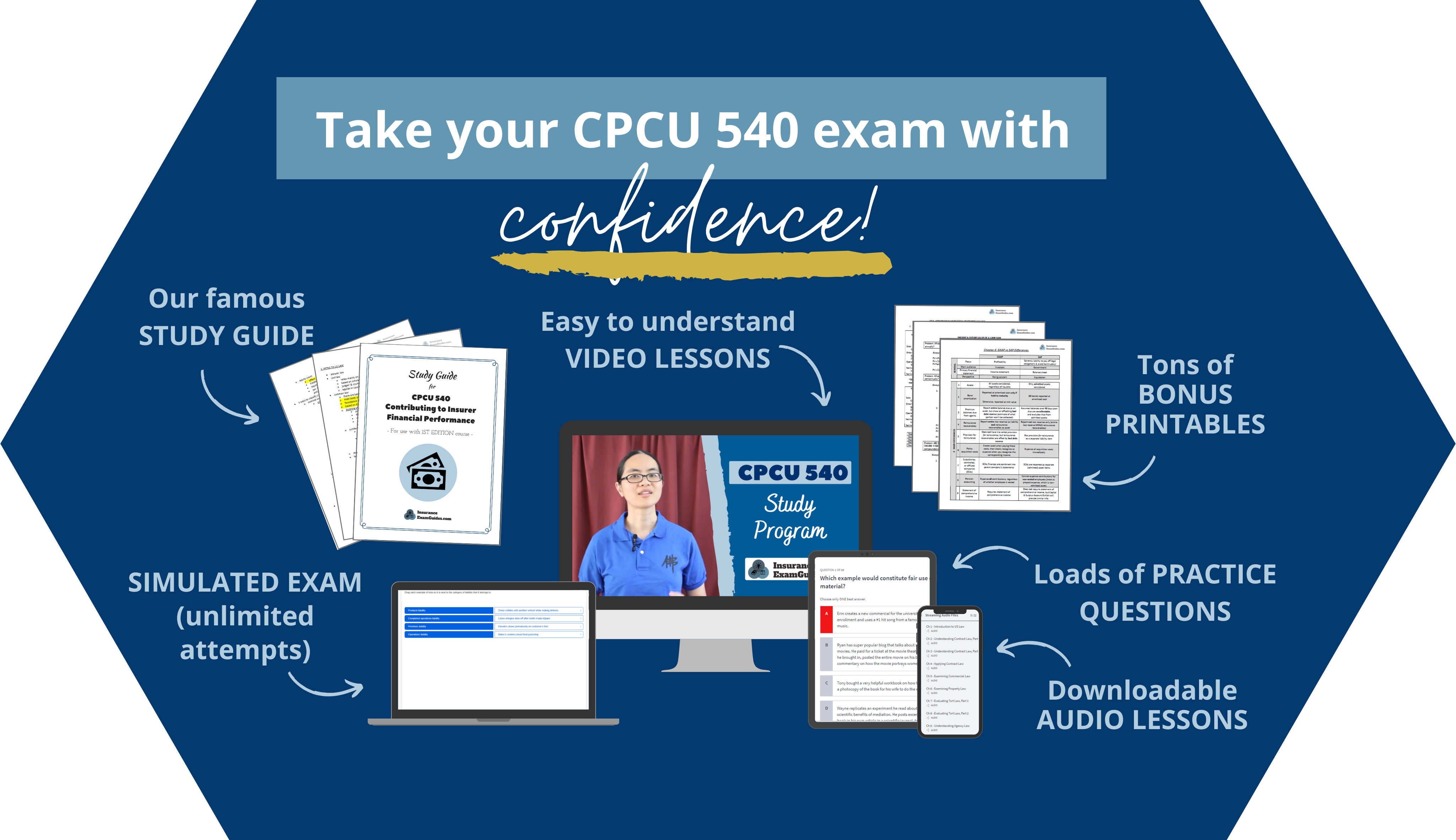

CPCU 540 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 540: Contributing to Insurer Financial Performance (1st edition)

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.