Completing the Chartered Property Casualty Underwriter (CPCU®) program is one of the best ways to advance your insurance career, but the program can be expensive and challenging. In this post, we’ll go over everything you need to know about the CPCU program.

What’s in this post

- About the designation

- About the exams

- Study materials

- Other helpful resources

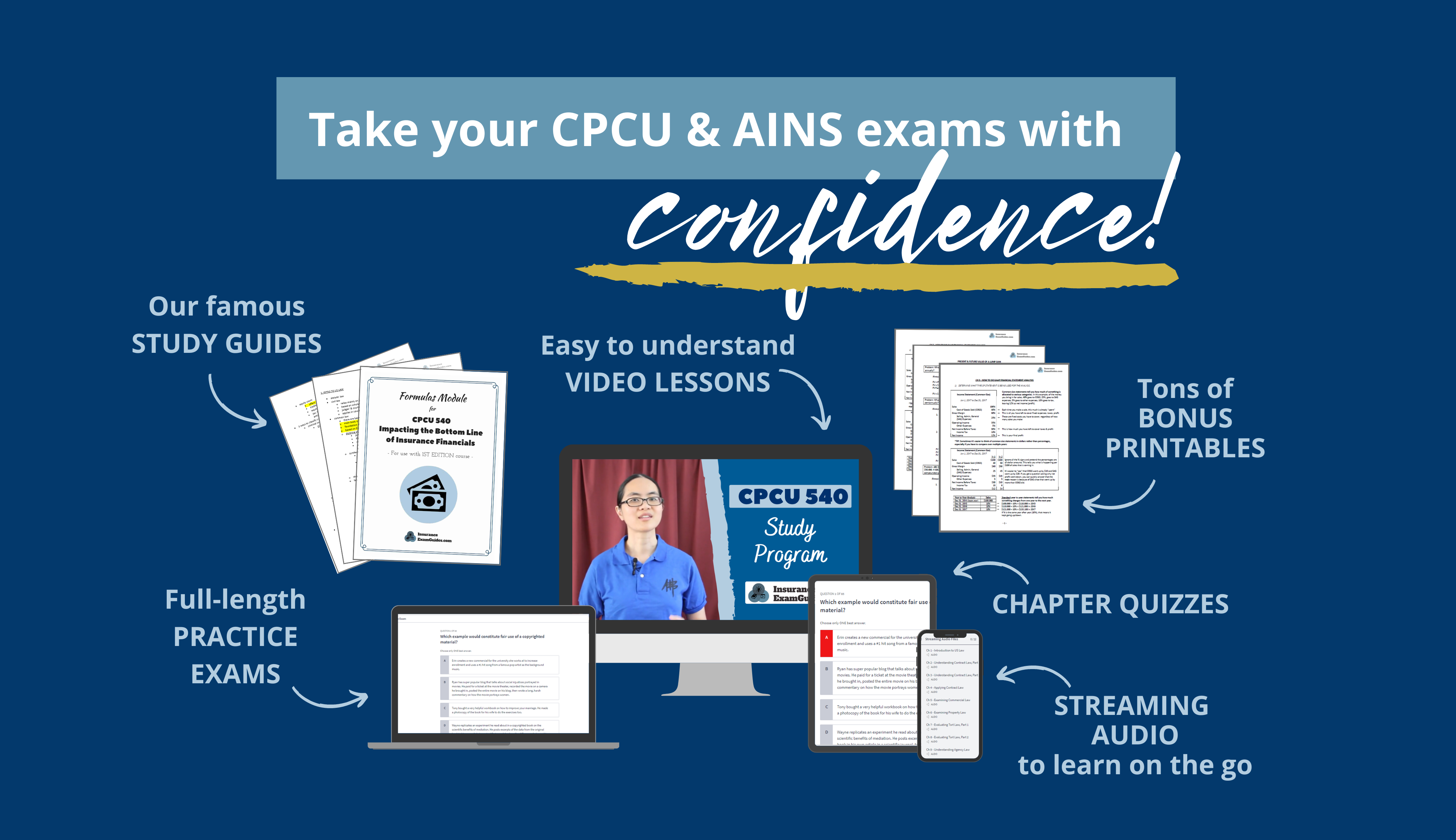

Ace your AINS® & CPCU® exams with the help of our study materials!

What is the CPCU program?

The Chartered Property Casualty Underwriter (CPCU®) is a professional designation offered by an organization called The Institutes. After completing the program, you will have a solid understanding of how insurance industry works and can display the CPCU designation on your business cards, resume, etc.

Having this designation shows that you have done extra education, which can make you a stronger candidate for hire or promotion. Also, this might give customers, colleagues, and business partners more confidence in working with you because they know you have this foundational knowledge.

Is getting a CPCU worth it?

Getting the designation is not cheap, and you will need to invest a lot of study time to complete the program. As such, it is important to think about whether the benefits of the designation will outweigh the costs.

We have an entire article dedicated to helping you decide if pursuing the designation would be worth it for you. The article covers:

- What benefits are associated with the designation

- How likely you are to actually realize those benefits

- Who SHOULD pursue the designation

- Who SHOULD NOT pursue the designation

To read the full article, click here.

What are the requirements for CPCU?

Traditional path

The traditional path, which most students take, requires you to pass individual exams for each of the following courses:

-

Five foundational courses (CPCU 500, CPCU 520, CPCU 530, CPCU 540, CPCU 550)

-

Two concentration courses, with either a commercial lines concentration (CPCU 551, CPCU 552) or a personal lines concentration (CPCU 555, CPCU 556)

-

One elective course (see The Institutes’ website for a full list of eligible electives, which changes periodically)

-

One ethics course (ETHICS 311)

ARM to CPCU path path

There is also an alternative path called the ARM to CPCU program that allows you to bypass some of the core CPCU courses from the traditional path. Once you are done with this path, you will have two designations:

- Chartered Property Casualty Underwriter (CPCU) designation

- Associate in Risk Management (ARM) designation at the same time

This path requires you to pass individual exams for each of the following courses:

-

Three ARM courses (ARM 400, ARM 401, ARM 402)

- Two foundational CPCU courses (CPCU 530, CPCU 540)

-

Two concentration courses, with either a commercial lines concentration (CPCU 551, CPCU 552) or a personal lines concentration (CPCU 555, CPCU 556)

-

One elective course (see The Institutes’ website for a full list of eligible electives, which changes periodically)

-

One ethics course (ETHICS 311)

Other requirements

Regardless of which path you choose, in addition to passing the required exams, you must also:

-

Have at least two years of experience in risk management or insurance

-

Pay a matriculation fee to The Institutes

Get a free study plan generator and CPCU progress tracker!

Join our mailing list and score these free tools.

How much does a CPCU cost?

There are three types of expenses that you will incur while pursuing your designation:

- Exam fees

- Study materials

- Matriculation fee

For a detailed discussion of the exam fees and the cost of study materials, click on the links above to jump straight to those portions of this article.

As of this writing, The Institutes charges a $90 matriculation fee to all students that can be paid at any time. The purpose of this fee is to cover the administrative costs of maintaining your student records. It is usually best to wait until you’ve passed all of your exams, just in case you decide later down the line that the program isn’t right for you.

What is the CPCU exam format?

- All CPCU exams are administered online by The Institutes

- Time limit: 65 minutes

- Number of questions: 50 questions

- Question types: Multiple choice, fill-in-the-blank, drag-and-drop

- Passing score: 70% of higher

To begin your exam, you must log-in to your account on The Institutes’ website and then click on the appropriate button in the “My Courses & Exams” section. The exam is not proctored or recorded, but you will need to sign an attestation that you will abide by all ethical guidelines.

How do you register for a CPCU exam?

Before you take each exam, you must register for it first and pay the exam fee. This can be done online at The Institutes’ website or by phone though their customer service line.

Exams must be taken sometime during the four available testing windows:

- Quarter 1: January 15 to March 15

- Quarter 2: April 15 to June 15

- Quarter 3: July 15 to September 15

- Quarter 4: October 15 to December 15

When you register for an exam, you must indicate which window you plan to take your exam in. For any given test window, you can register at any time before or during that window, but The Institutes will typically offer students a significant discount for registering before the first day of the testing window.

If you want to reschedule your test to a different test window, you can do so for an extra fee ($95, as of this writing). It is best to plan carefully so you can avoid incurring this extra charge.

CLICK HERE TO GET STARTED

How much does the CPCU exam cost?

As of this writing, the exam fee for each CPCU course is $380, but you can get an $80 early bird discount by registering for your exam before the first day of the testing window (ex: if you plan to take your exam during Quarter 1 and register before January 15, you will receive the discount).

The cost of the exam for your elective will vary depending on which elective you choose, but the exam fees for elective courses tend to be slightly cheaper than the exam fee for a CPCU course. The fees for elective exams tend to range from $210 to $285 for most of those courses.

What is the CPCU exam pass rate?

The Institutes no longer publishes pass rates for each specific course, but according to their frequently asked questions, the average pass rate between all exams is 72.5%. Keep in mind that this includes non-CPCU exams, which tend to be easier than the CPCU exams, so the pass rate for the CPCU-specific courses is likely to be slightly lower than that. In order to pass your exam, you need a score of at least 70% or higher.

If you do not pass your exam, you can retake it subject to the following limitations:

- You must pay the exam fee again (if you schedule your retake for the same test window or a future one that hasn’t opened yet, you may qualify for the early bird discount again)

- You may only reattempt the same exam up to four times per year

- If you wish to reattempt the exam in the same test window, you are only allowed one extra retake per window

Tips for passing your CPCU exams

The best way to prepare for your exam is to thoroughly study the material, but we do have a few additional strategies that can give you an extra edge. Check out our “Ultimate Guide to CPCU _” blog series to see a list of strategies for each specific course.

How we compare to The Institutes (CPCU®)

Save BIG and get more features!

Insurance Exam Guides |

The Institutes

|

|

$169.99 |

$399.00 |

|

| Length of access | No expiration date | One year from purchase date |

| Video lessons | Full video library | Some videos (most lessons are text-only) |

| Searchable video transcripts (read the content and jump to specific video sections) |

✓ | |

| Downloadable audio lessons (streaming option also included) |

✓ | |

| Chapter quizzes | ✓ | ✓ |

| Simulated exam (timed) | Unlimited attempts | One attempt |

| Study guide | Comprehensive study guide | Basic chapter outlines |

| Course updates | Free lifetime updates (when we update our content, you get the new material at no extra cost) |

No free updates (you must repurchase to get updated content) |

CLICK HERE TO GET STARTED

How to save money on CPCU study materials

Between the exam fees and paying for study materials, pursuing your designation is not a cheap endeavor. Fortunately, there are many ways to save money and make the journey more affordable. Click here to see a list of our top tips for saving money on your study materials.

Other helpful resources

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

CLICK HERE TO GET STARTED

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.