One of the key concepts you will be studying in CPCU 540 is zero-coupon bonds. Here is the difference between a regular bond & a zero-coupon bond:

When you buy a regular bond, you pay the face value for it. While you own the bond, you’ll get interest paid to you periodically until the maturity date, at which time the face value gets paid/returned to you. As such, your earnings or profits come from the interest you get paid. So, let’s say I buy a $100 bond for $100, I get $5 a year for 3 years, then I get my $100 back at the maturity date – my profit is $15 (from in interest).

Historically, when you bought a regular bond, it literally had coupons attached that you had to mail in or drop off to redeem the interest payments at the specified interval. A zero-coupon bond gets its name from the fact that they had no coupons to turn in, because you didn’t get any interest.

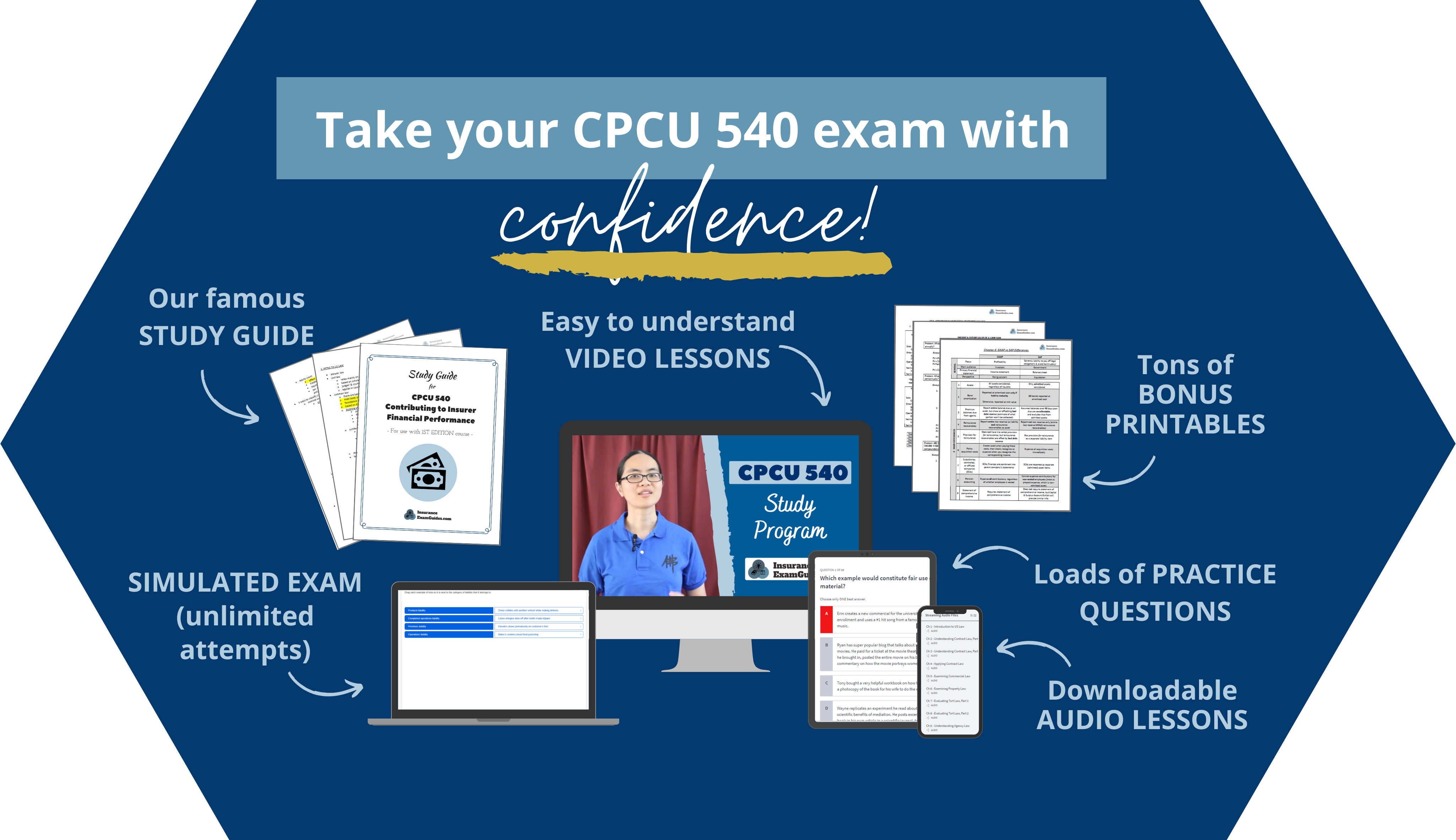

Hopefully, this explanation sheds some light for anyone else that was struggling to understand these terms. But we can help you with more than just zero-coupon bonds! We’ve launched our CPCU 540 study materials, which is based on the third edition release. It is jam-packed with tons of bonus content to help you master the concepts – get your e-bundle today!

CPCU 540 Study Materials

-

For buyer's personal use only (non-transferrable and not for resale)

-

Based on CPCU 540: Contributing to Insurer Financial Performance (1st edition)

Full Study Program

Everything you need to fully prepare- Online video lessons (with searchable transcripts)

- Downloadable MP3 audio lessons

- Comprehensive study guide (PDF)

- Bonus Printables (PDF) (see full list below)

- Chapter quizzes

- Simulated exam (unlimited attempts)

- Free lifetime updates

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

Get your CPCU 540 study materials NOW!

Looking for our printables-only package? Click here.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.